Answered step by step

Verified Expert Solution

Question

1 Approved Answer

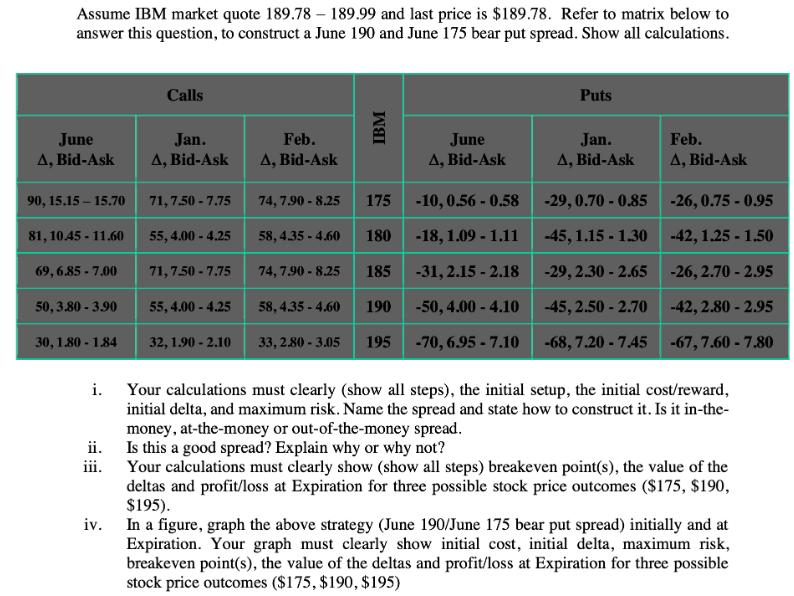

Assume IBM market quote 189.78 - 189.99 and last price is $189.78. Refer to matrix below to answer this question, to construct a June

Assume IBM market quote 189.78 - 189.99 and last price is $189.78. Refer to matrix below to answer this question, to construct a June 190 and June 175 bear put spread. Show all calculations. June A,Bid-Ask 90, 15.15-15.70 81, 10.45-11.60 69,6.85-7.00 50,3.80-3.90 30,1.80 - 1.84 i. ii. iii. Calls Jan. A,Bid-Ask 71,7.50 -7.75 55, 4.00 -4.25 71,7.50 -7.75 55, 4.00 -4.25 32, 1.90 -2.10 Feb. A,Bid-Ask 74,7.90-8.25 175 58,4.35 -4.60 180 74,7.90-8.25 185 190 195 58,4.35 -4.60 IBM 33, 2.80 - 3.05 June A,Bid-Ask -10,0.56 -0.58 -18, 1.09 - 1.11 -31, 2.15-2.18 -50, 4.00- 4.10 -70, 6.95-7.10 Puts Jan. A,Bid-Ask -29, 0.70 -0.85 -45, 1.15-1.30 -29,2.30-2.65 -45, 2.50 -2.70 -68,7.20-7.45 Feb. A,Bid-Ask -26,0.75 -0.95 -42, 1.25 -1.50 -26, 2.70-2.95 -42,2.80-2.95 -67,7.60-7.80 Your calculations must clearly (show all steps), the initial setup, the initial cost/reward, initial delta, and maximum risk. Name the spread and state how to construct it. Is it in-the- money, at-the-money or out-of-the-money spread. Is this a good spread? Explain why or why not? Your calculations must clearly show (show all steps) breakeven point(s), the value of the deltas and profit/loss at Expiration for three possible stock price outcomes ($175, $190, $195). iv. In a figure, graph the above strategy (June 190/June 175 bear put spread) initially and at Expiration. Your graph must clearly show initial cost, initial delta, maximum risk, breakeven point(s), the value of the deltas and profit/loss at Expiration for three possible stock price outcomes ($175, $190, $195)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

i The spread we will construct is called the June 190June 175 Bear Put Spread To construct this spread we will buy 100 shares of the June 190 put opti...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started