Answered step by step

Verified Expert Solution

Question

1 Approved Answer

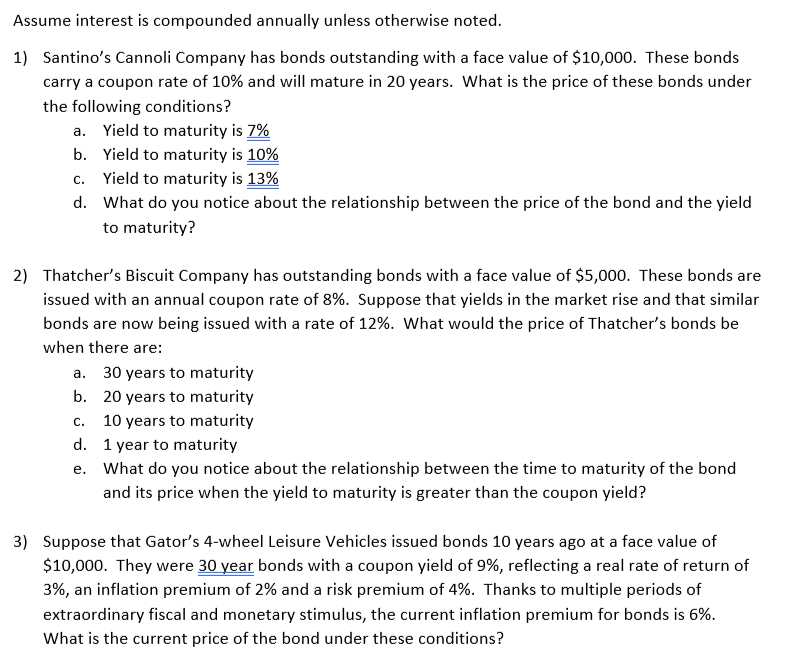

Assume interest is compounded annually unless otherwise noted. Santino's Cannoli Company has bonds outstanding with a face value of $ 1 0 , 0 0

Assume interest is compounded annually unless otherwise noted.

Santino's Cannoli Company has bonds outstanding with a face value of $ These bonds

carry a coupon rate of and will mature in years. What is the price of these bonds under

the following conditions?

a Yield to maturity is

b Yield to maturity is

c Yield to maturity is

d What do you notice about the relationship between the price of the bond and the yield

to maturity?

Thatcher's Biscuit Company has outstanding bonds with a face value of $ These bonds are

issued with an annual coupon rate of Suppose that yields in the market rise and that similar

bonds are now being issued with a rate of What would the price of Thatcher's bonds be

when there are:

a years to maturity

b years to maturity

c years to maturity

d year to maturity

e What do you notice about the relationship between the time to maturity of the bond

and its price when the yield to maturity is greater than the coupon yield?

Suppose that Gator's wheel Leisure Vehicles issued bonds years ago at a face value of

$ They were year bonds with a coupon yield of reflecting a real rate of return of

an inflation premium of and a risk premium of Thanks to multiple periods of

extraordinary fiscal and monetary stimulus, the current inflation premium for bonds is

What is the current price of the bond under these conditions?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started