Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assume it is January 1, 2024. Shubha is managing her financial portfolio and calculates that her liabilities - including credit card payments, student loans,

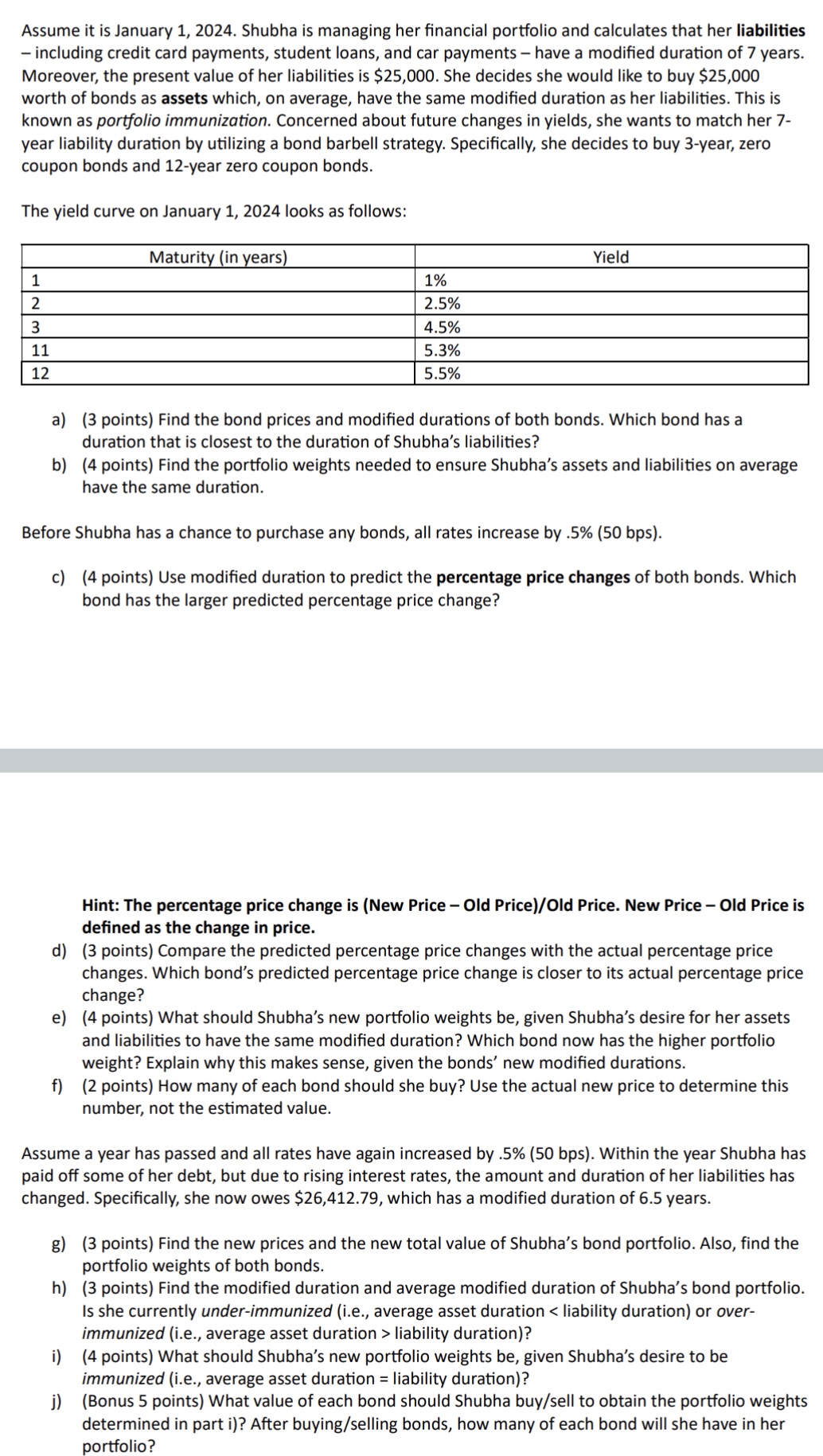

Assume it is January 1, 2024. Shubha is managing her financial portfolio and calculates that her liabilities - including credit card payments, student loans, and car payments - have a modified duration of 7 years. Moreover, the present value of her liabilities is $25,000. She decides she would like to buy $25,000 worth of bonds as assets which, on average, have the same modified duration as her liabilities. This is known as portfolio immunization. Concerned about future changes in yields, she wants to match her 7- year liability duration by utilizing a bond barbell strategy. Specifically, she decides to buy 3-year, zero coupon bonds and 12-year zero coupon bonds. The yield curve on January 1, 2024 looks as follows: Maturity (in years) 1 2 3 11 12 1% 2.5% 4.5% 5.3% 5.5% Yield a) (3 points) Find the bond prices and modified durations of both bonds. Which bond has a duration that is closest to the duration of Shubha's liabilities? b) (4 points) Find the portfolio weights needed to ensure Shubha's assets and liabilities on average have the same duration. Before Shubha has a chance to purchase any bonds, all rates increase by .5% (50 bps). c) (4 points) Use modified duration to predict the percentage price changes of both bonds. Which bond has the larger predicted percentage price change? Hint: The percentage price change is (New Price - Old Price)/Old Price. New Price - Old Price is defined as the change in price. d) (3 points) Compare the predicted percentage price changes with the actual percentage price changes. Which bond's predicted percentage price change is closer to its actual percentage price change? e) (4 points) What should Shubha's new portfolio weights be, given Shubha's desire for her assets and liabilities to have the same modified duration? Which bond now has the higher portfolio weight? Explain why this makes sense, given the bonds' new modified durations. f) (2 points) How many of each bond should she buy? Use the actual new price to determine this number, not the estimated value. Assume a year has passed and all rates have again increased by .5% (50 bps). Within the year Shubha has paid off some of her debt, but due to rising interest rates, the amount and duration of her liabilities has changed. Specifically, she now owes $26,412.79, which has a modified duration of 6.5 years. g) (3 points) Find the new prices and the new total value of Shubha's bond portfolio. Also, find the portfolio weights of both bonds. h) (3 points) Find the modified duration and average modified duration of Shubha's bond portfolio. Is she currently under-immunized (i.e., average asset duration < liability duration) or over- immunized (i.e., average asset duration > liability duration)? i) (4 points) What should Shubha's new portfolio weights be, given Shubha's desire to be immunized (i.e., average asset duration = liability duration)? j) (Bonus 5 points) What value of each bond should Shubha buy/sell to obtain the portfolio weights determined in part i)? After buying/selling bonds, how many of each bond will she have in her portfolio?

Step by Step Solution

★★★★★

3.46 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

a To find the bond prices and modified durations we can use the formula Bond Price Face Value 1 YieldMaturity Modified Duration Maturity 1 Yield For the 3year zero coupon bond Bond Price 25000 1 00453 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started