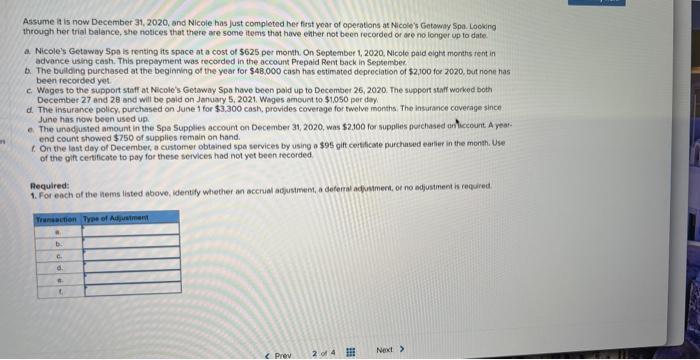

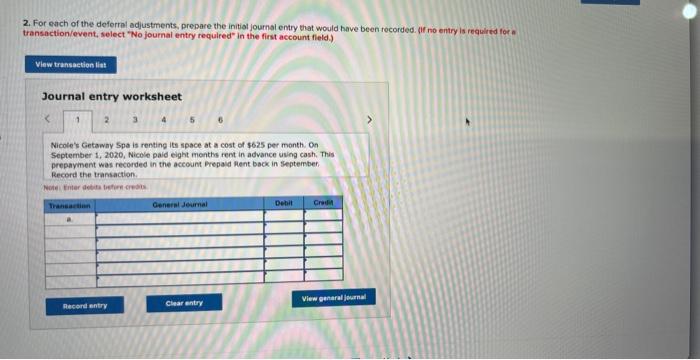

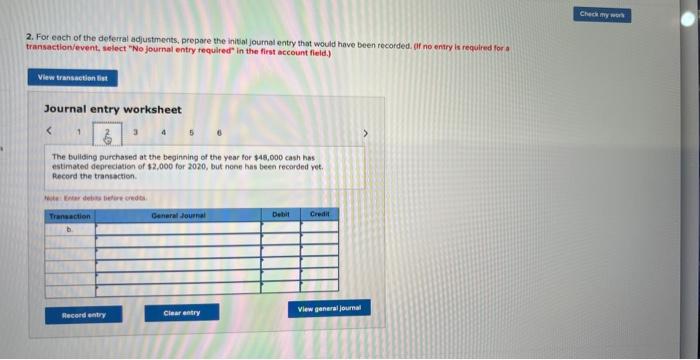

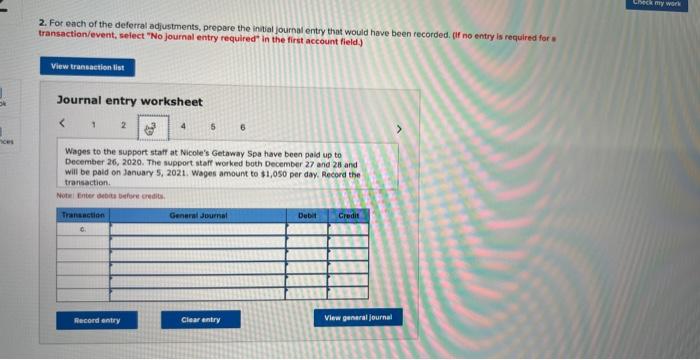

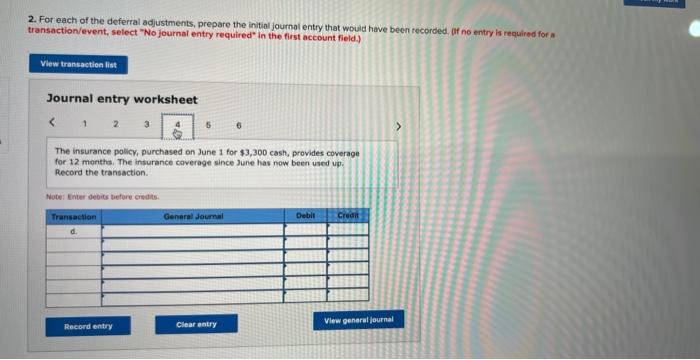

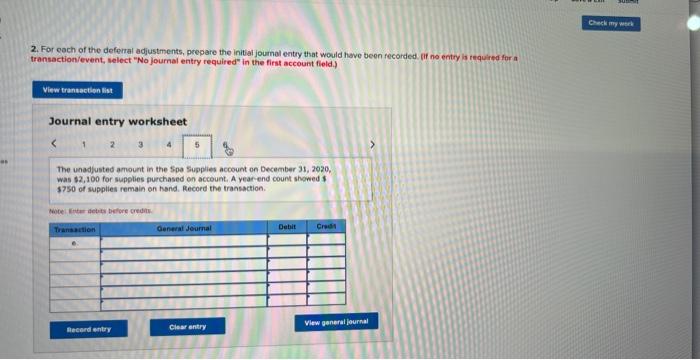

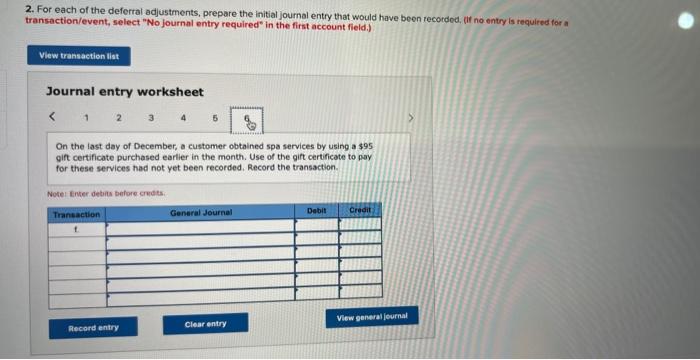

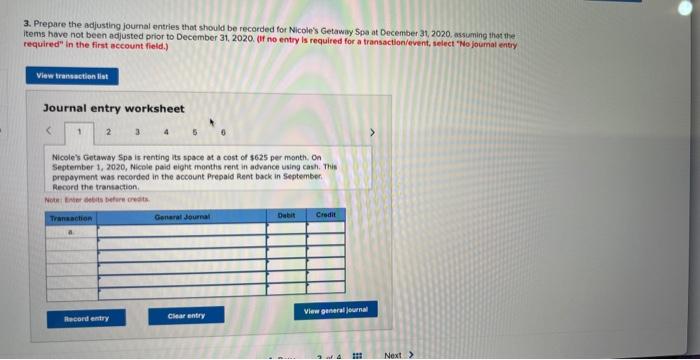

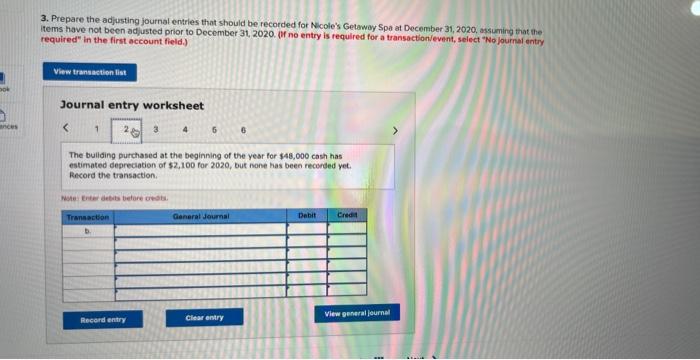

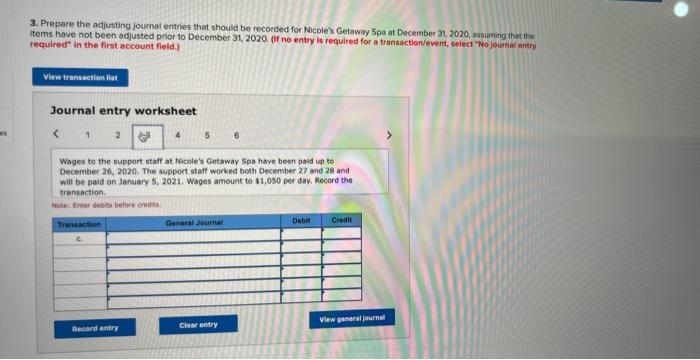

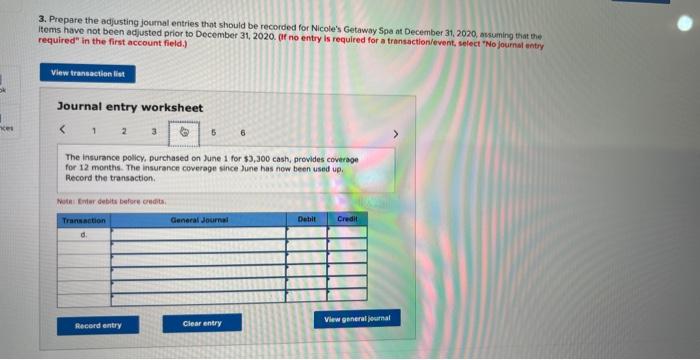

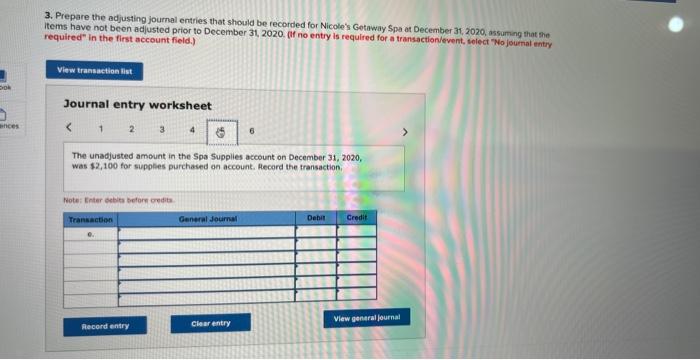

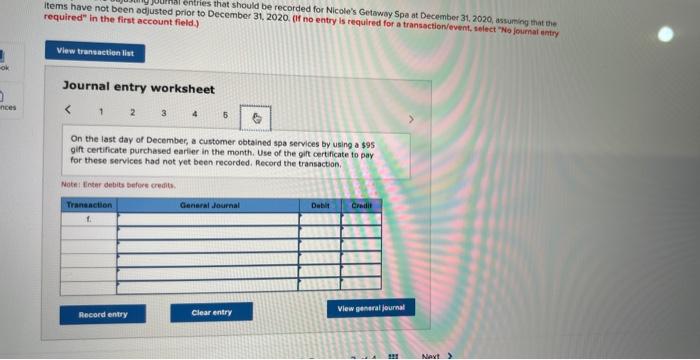

Assume it is now December 31, 2020, and Nicole has just completed her first yoar of operations at Nicote's Goteway Spo. Looking through her trial balance, she notices that there are some iteens that have enther not beea rocorded or are no longer up to date. a. Nicole's Getaway Spo is renting its space at a cost of $625 per month. On September 1, 2020 , Nicole paid eight months tnt in advance using cash. This prepayment was tecorded in the account Prepaid Rent back in Septembec. b. The bulding purchased at the beginning of the year for $48.000 cash has estimated depreciation of $2,100 for 2020 , put none has been recorded yet. c. Wages to the support staff at Nicole's Getaway Spa have been paid up to December 26, 2020. The support stam worked both December 27 and 28 and will be paid on Jannary 5, 2021. Wages amount to $1,050 per day d. The insurance policy. purchased on June 1 for $3.300 cash. provides coverage for fwelve months the insurance coverage since June has now been used up. e. The unodjusted amount in the Spa Supplies account on December 31,2020 , was $2.100 for supplies purchased aniccount A yearend count showed $750 of supplies remain on hand. 1. On the last day of December, a customer obtained spe secvices by using a$95 gift cethificare purchased earlier in the monsh, Use. of the git certificate to pay for these services had not yet been recorded Required: 1. For eoch of the hems listed above. identify whether an accrual agjusimem, a deferal adjusiment, of no edjustinent is required. Required: 2. For each of the deferral adjustments, prepare the initiol journal entry that would have been recorded. af no entry is reauited for a transaction/event, select "No journal entry required" in the first account fleld.). Journal entry worksheet 236 Nicole's Getaway Spa is renting its space at a cost of $625 per month. On September 1, 2020, Nicoie paid eight menthe rent in advance uving cash. This prepayment was recorded in the accoum Frepald llent back in septemben. Record the transaction. 2. For each of the deferral adjustments, prepare the initial joumal entry that would have been recorded. af no eniry is required for a transaction/event, select "No journal entry required" in the first account field.) Journal entry worksheet The buliding purchased at the beginning of the year for $48,000 cash has estimated degreciation of $2,000 for 2020, but nene has been recorded yet. Record the transiaction. 2. For ench of the deferral adjustments, prepare the intial journal entry that would have been recorded, af no entry is required for : transaction/event, select "No journal entry required" in the first account field) Journal entry worksheet Wages to the support staff at Nicole's Getaway Spa have been paid up to December 26, 2020. The support staff worked both December 27 and 28 and will be paid on January 5, 2021. Woges amount to $1,050 per day. Record the transaction. Nutar Inber bebal bether crediti. 2. For each of the deferral adjustments, prepare the initial journal entry that would have been recorded, of no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Journal entry worksheet 6 The insurance policy, purchased on June 1 for $3,300 cash, provides coverage for 12 months. The insurance coverage since June has now been used up. Record the transaction. Notei Lnter debits taefore credts. 2. For each of the deferral adjustments, prepare the initial joumal entry that would hove been recorded. fir no entry is thquired for a transaction/event, select "No journal entry required" in the first account field.) Journal entry worksheet