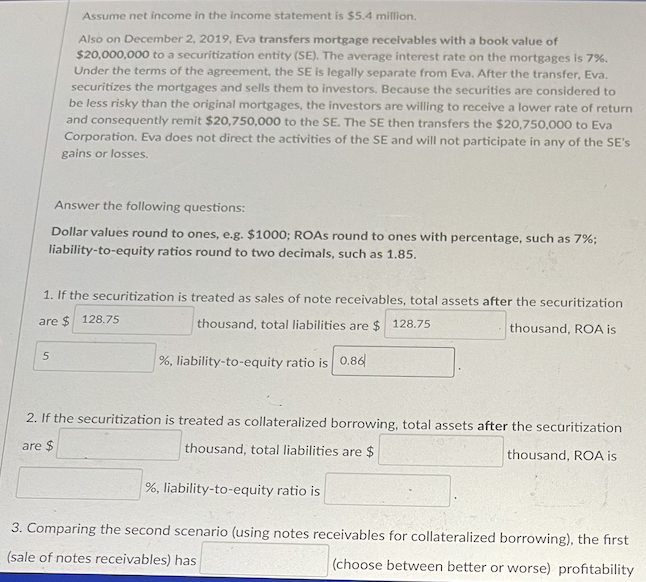

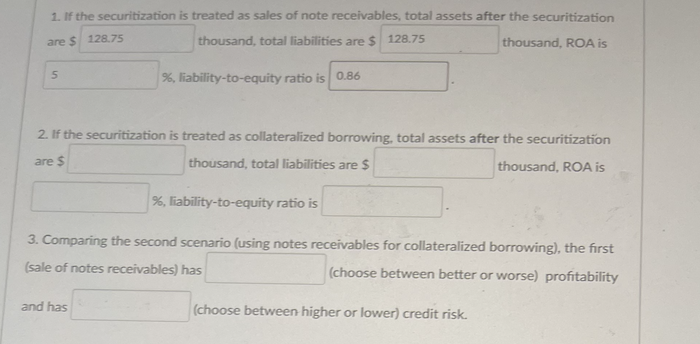

Assume net income in the income statement is $5.4 million. Also on December 2, 2019. Eva transfers mortgage receivables with a book value of $20,000,000 to a securitization entity (SE). The average interest rate on the mortgages is 7%. Under the terms of the agreement, the SE is legally separate from Eva. After the transfer, Eva. securitizes the mortgages and sells them to investors. Because the securities are considered to be less risky than the original mortgages, the investors are willing to receive a lower rate of return and consequently remit $20,750,000 to the SE. The SE then transfers the $20,750,000 to Eva Corporation. Eva does not direct the activities of the SE and will not participate in any of the SE's gains or losses. Answer the following questions: Dollar values round to ones, e.g. $1000; ROAs round to ones with percentage, such as 7%; liability-to-equity ratios round to two decimals, such as 1.85. 1. If the securitization is treated as sales of note receivables, total assets after the securitization are $ 128.75 thousand, total liabilities are $ 128.75 thousand, ROA is 5 %, liability-to-equity ratio is 0.86 2. If the securitization is treated as collateralized borrowing, total assets after the securitization are $ thousand, total liabilities are $ thousand, ROA is %, liability-to-equity ratio is 3. Comparing the second scenario (using notes receivables for collateralized borrowing), the first (sale of notes receivables) has (choose between better or worse) profitability 1. If the securitization is treated as sales of note receivables, total assets after the securitization thousand, total liabilities are $ 128.75 thousand, ROA is are S 128.75 5 %, liability-to-equity ratio is 0.86 2. If the securitization is treated as collateralized borrowing, total assets after the securitization thousand, total liabilities are $ thousand, ROA is are $ %, liability-to-equity ratio is 3. Comparing the second scenario (using notes receivables for collateralized borrowing), the first (sale of notes receivables) has (choose between better or worse) profitability and has (choose between higher or lower) credit risk. Assume net income in the income statement is $5.4 million. Also on December 2, 2019. Eva transfers mortgage receivables with a book value of $20,000,000 to a securitization entity (SE). The average interest rate on the mortgages is 7%. Under the terms of the agreement, the SE is legally separate from Eva. After the transfer, Eva. securitizes the mortgages and sells them to investors. Because the securities are considered to be less risky than the original mortgages, the investors are willing to receive a lower rate of return and consequently remit $20,750,000 to the SE. The SE then transfers the $20,750,000 to Eva Corporation. Eva does not direct the activities of the SE and will not participate in any of the SE's gains or losses. Answer the following questions: Dollar values round to ones, e.g. $1000; ROAs round to ones with percentage, such as 7%; liability-to-equity ratios round to two decimals, such as 1.85. 1. If the securitization is treated as sales of note receivables, total assets after the securitization are $ 128.75 thousand, total liabilities are $ 128.75 thousand, ROA is 5 %, liability-to-equity ratio is 0.86 2. If the securitization is treated as collateralized borrowing, total assets after the securitization are $ thousand, total liabilities are $ thousand, ROA is %, liability-to-equity ratio is 3. Comparing the second scenario (using notes receivables for collateralized borrowing), the first (sale of notes receivables) has (choose between better or worse) profitability 1. If the securitization is treated as sales of note receivables, total assets after the securitization thousand, total liabilities are $ 128.75 thousand, ROA is are S 128.75 5 %, liability-to-equity ratio is 0.86 2. If the securitization is treated as collateralized borrowing, total assets after the securitization thousand, total liabilities are $ thousand, ROA is are $ %, liability-to-equity ratio is 3. Comparing the second scenario (using notes receivables for collateralized borrowing), the first (sale of notes receivables) has (choose between better or worse) profitability and has (choose between higher or lower) credit risk