Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assume Net Income is $28,000. What is Retained Earnings as of December 31st (ending)? Answer= A Assume retained earnings as of Dec. 31st is

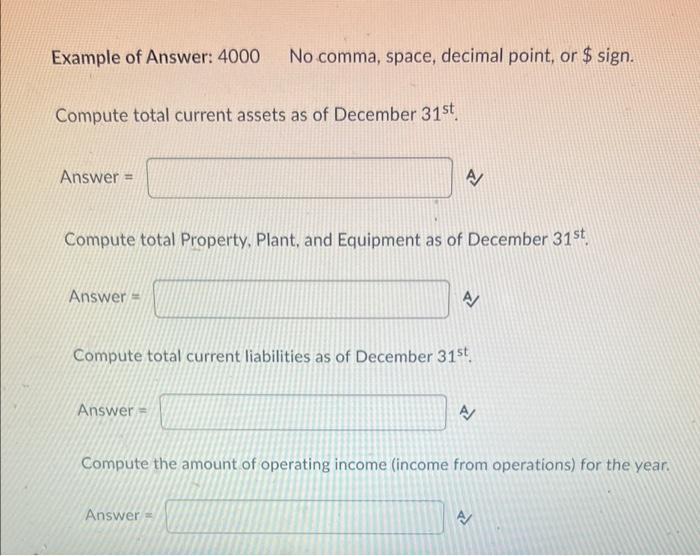

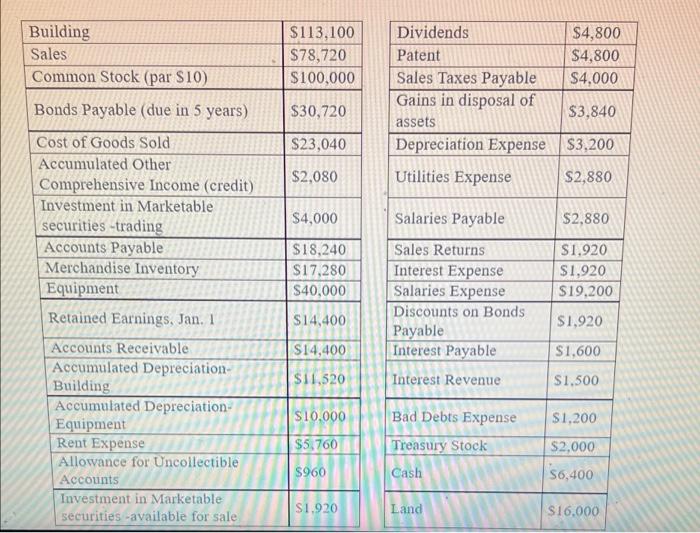

Assume Net Income is $28,000. What is Retained Earnings as of December 31st (ending)? Answer= A Assume retained earnings as of Dec. 31st is $40,000. Based on data given, what is the TOTAL amount of Stockholders' Equity as of Dec. 31st? Answer= Example of Answer: 4000 No comma, space, decimal point, or $ sign. Compute total current assets as of December 31st Answer= Compute total Property. Plant, and Equipment as of December 31st. Answer= A Answer= Compute total current liabilities as of December 31st. Z Answer = A/ Compute the amount of operating income (income from operations) for the year. Building Sales Common Stock (par $10) Bonds Payable (due in 5 years) Cost of Goods Sold Accumulated Other Comprehensive Income (credit) Investment in Marketable securities-trading Accounts Payable Merchandise Inventory Equipment Retained Earnings, Jan. 1 Accounts Receivable. Accumulated Depreciation- Building Accumulated Depreciation- Equipment Rent Expense Allowance for Uncollectible Accounts Investment in Marketable securities available for sale $113,100 $78,720 $100,000 $30,720 $23,040 $2,080 $4,000 $18,240 $17,280 $40,000 $14,400 $14,400 $11,520 $10,000 $5,760 $960 $1,920 Dividends Patent Sales Taxes Payable Gains in disposal of assets Depreciation Expense Utilities Expense Salaries Payable Sales Returns Interest Expense Salaries Expense Discounts on Bonds Payable Interest Payable Interest Revenue Bad Debts Expense Treasury Stock Cash Land $4,800 $4,800 $4,000 $3,840 $3,200 $2,880 $2,880 $1,920 $1,920 $19,200 $1,920 $1,600 $1,500 $1,200 $2,000 $6,400 $16,000

Step by Step Solution

★★★★★

3.54 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

1 Calculate the Retained Earnings as of December 31st we can use the formula Assuming Net Income is ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started