Question

Assume no other adjusting entries are made during the year. a. Accumulated Depreciation: The Krug Company's Accumulated Depreciation account has a $16,000 balance to

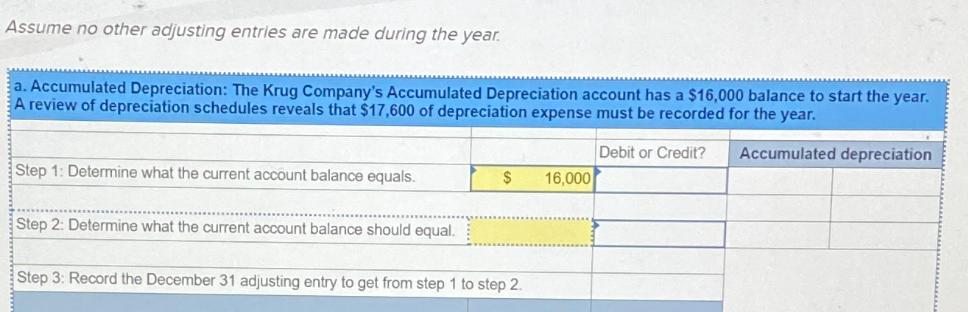

Assume no other adjusting entries are made during the year. a. Accumulated Depreciation: The Krug Company's Accumulated Depreciation account has a $16,000 balance to start the year. A review of depreciation schedules reveals that $17,600 of depreciation expense must be recorded for the year. Debit or Credit? Step 1: Determine what the current account balance equals. $ 16,000 Step 2: Determine what the current account balance should equal. Step 3: Record the December 31 adjusting entry to get from step 1 to step 2. Accumulated depreciation

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Lets break down the steps to address the Accumulated Depreciation issue for Krug Company Step 1 Dete...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamental accounting principle

Authors: John J. Wild, Ken W. Shaw, Barbara Chiappetta

21st edition

1259119831, 9781259311703, 978-1259119835, 1259311708, 978-0078025587

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App