Answered step by step

Verified Expert Solution

Question

1 Approved Answer

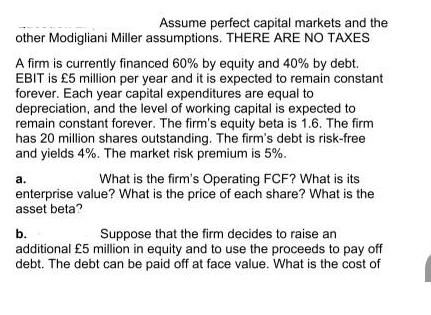

Assume perfect capital markets and the other Modigliani Miller assumptions. THERE ARE NO TAXES A firm is currently financed 60% by equity and 40%

Assume perfect capital markets and the other Modigliani Miller assumptions. THERE ARE NO TAXES A firm is currently financed 60% by equity and 40% by debt. EBIT is 5 million per year and it is expected to remain constant forever. Each year capital expenditures are equal to depreciation, and the level of working capital is expected to remain constant forever. The firm's equity beta is 1.6. The firm has 20 million shares outstanding. The firm's debt is risk-free and yields 4%. The market risk premium is 5%. What is the firm's Operating FCF? What is its enterprise value? What is the price of each share? What is the asset beta? a. b. Suppose that the firm decides to raise an additional 5 million in equity and to use the proceeds to pay off debt. The debt can be paid off at face value. What is the cost of

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a To calculate the firms Operating Free Cash Flow FCF Enterprise Value EV share price and asset beta ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started