Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assume Sarah is a cash-method, calendar-year taxpayer, and she is considering making the following cash payments related to her business. Calculate the after-tax cost

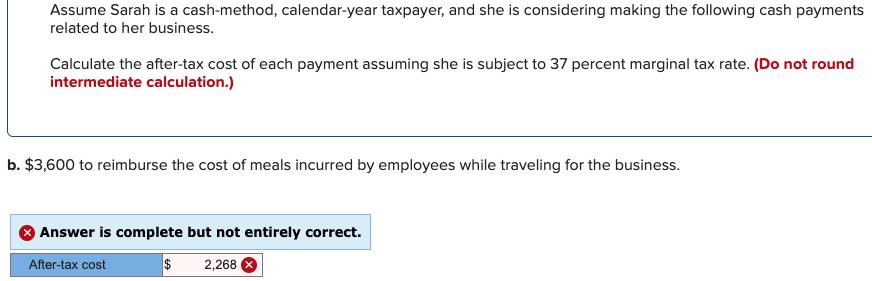

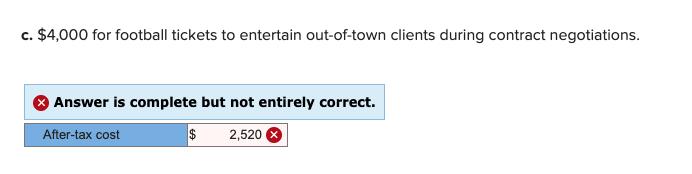

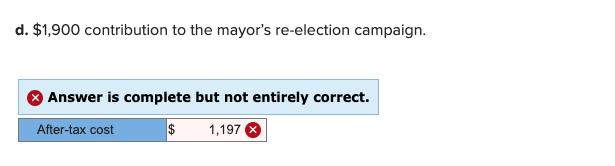

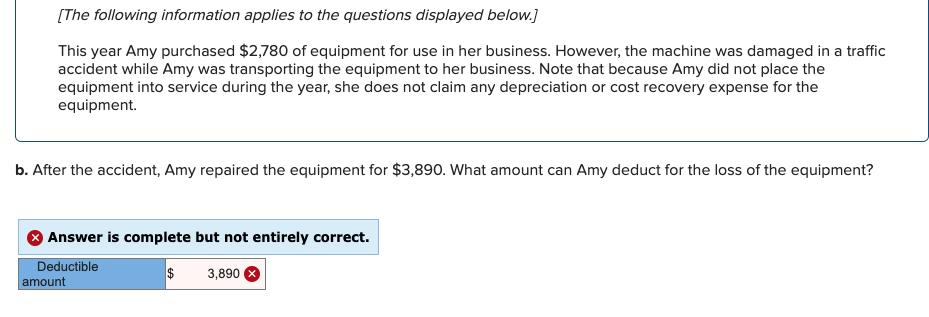

Assume Sarah is a cash-method, calendar-year taxpayer, and she is considering making the following cash payments related to her business. Calculate the after-tax cost of each payment assuming she is subject to 37 percent marginal tax rate. (Do not round intermediate calculation.) b. $3,600 to reimburse the cost of meals incurred by employees while traveling for the business. O Answer is complete but not entirely correct. After-tax cost $ 2,268 c. $4,000 for football tickets to entertain out-of-town clients during contract negotiations. OAnswer is complete but not entirely correct. After-tax cost 2,520 d. $1,900 contribution to the mayor's re-election campaign. Answer is complete but not entirely correct. After-tax cost $ 1,197 [The following information applies to the questions displayed below.] This year Amy purchased $2,780 of equipment for use in her business. However, the machine was damaged in a traffic accident while Amy was transporting the equipment to her business. Note that because Amy did not place the equipment into service during the year, she does not claim any depreciation or cost recovery expense for the equipment. b. After the accident, Amy repaired the equipment for $3,890. What amount can Amy deduct for the loss of the equipment? Answer is complete but not entirely correct. Deductible amount 24 3,890

Step by Step Solution

★★★★★

3.42 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started