Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assume that 10 years ago (Year -10) a firm issued 30-year bonds that had an annual coupon rate of 12 percent (paid $60 every

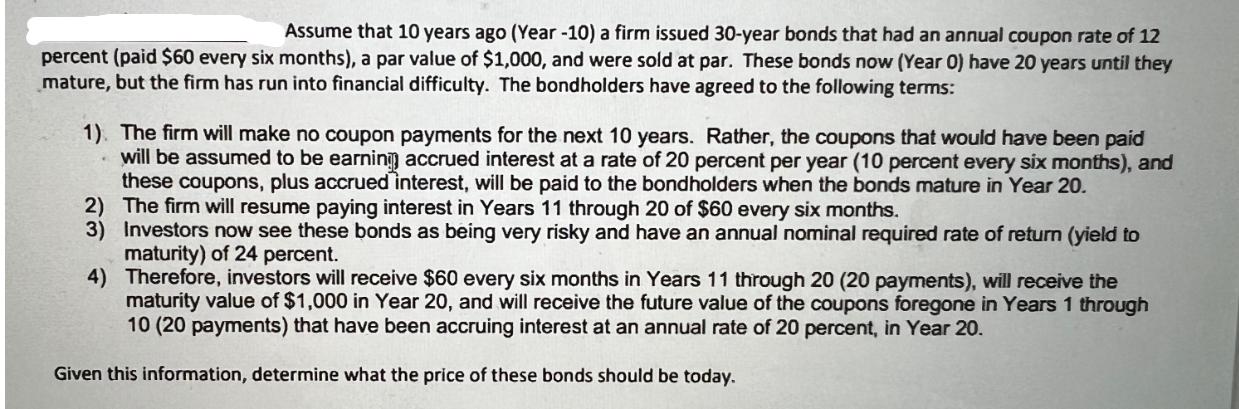

Assume that 10 years ago (Year -10) a firm issued 30-year bonds that had an annual coupon rate of 12 percent (paid $60 every six months), a par value of $1,000, and were sold at par. These bonds now (Year 0) have 20 years until they mature, but the firm has run into financial difficulty. The bondholders have agreed to the following terms: 1). The firm will make no coupon payments for the next 10 years. Rather, the coupons that would have been paid will be assumed to be earning accrued interest at a rate of 20 percent per year (10 percent every six months), and these coupons, plus accrued interest, will be paid to the bondholders when the bonds mature in Year 20. 2) The firm will resume paying interest in Years 11 through 20 of $60 every six months. 3) Investors now see these bonds as being very risky and have an annual nominal required rate of return (yield to maturity) of 24 percent. 4) Therefore, investors will receive $60 every six months in Years 11 through 20 (20 payments), will receive the maturity value of $1,000 in Year 20, and will receive the future value of the coupons foregone in Years 1 through 10 (20 payments) that have been accruing interest at an annual rate of 20 percent, in Year 20. Given this information, determine what the price of these bonds should be today.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started