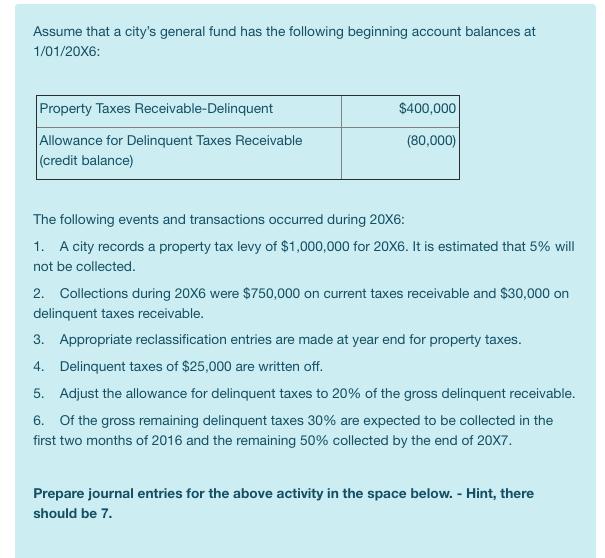

Assume that a city's general fund has the following beginning account balances at 1/01/20X6: Property Taxes Receivable-Delinquent Allowance for Delinquent Taxes Receivable (credit balance)

Assume that a city's general fund has the following beginning account balances at 1/01/20X6: Property Taxes Receivable-Delinquent Allowance for Delinquent Taxes Receivable (credit balance) $400,000 (80,000) The following events and transactions occurred during 20X6: 1. A city records a property tax levy of $1,000,000 for 20X6. It is estimated that 5% will not be collected. 2. Collections during 20X6 were $750,000 on current taxes receivable and $30,000 on delinquent taxes receivable. 3. Appropriate reclassification entries are made at year end for property taxes. 4. Delinquent taxes of $25,000 are written off. 5. Adjust the allowance for delinquent taxes to 20% of the gross delinquent receivable. 6. Of the gross remaining delinquent taxes 30% are expected to be collected in the first two months of 2016 and the remaining 50% collected by the end of 20X7. Prepare journal entries for the above activity in the space below. - Hint, there should be 7.

Step by Step Solution

3.46 Rating (169 Votes )

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started