Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assume that a manufacturing company has equipment (i.e., defender) that was installed 6 years ago for $150,000 and has a present market value of

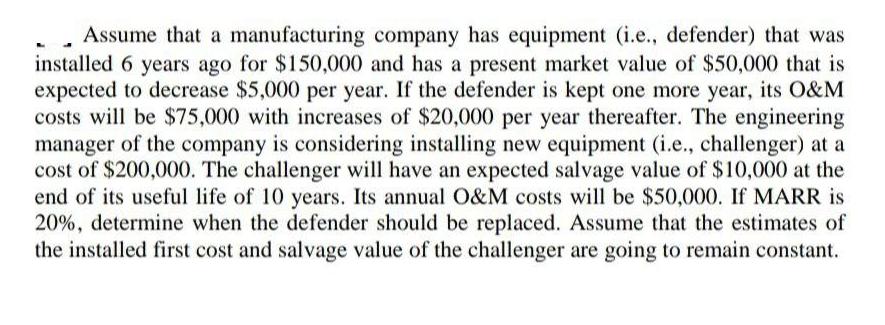

Assume that a manufacturing company has equipment (i.e., defender) that was installed 6 years ago for $150,000 and has a present market value of $50,000 that is expected to decrease $5,000 per year. If the defender is kept one more year, its O&M costs will be $75,000 with increases of $20,000 per year thereafter. The engineering manager of the company is considering installing new equipment (i.e., challenger) at a cost of $200,000. The challenger will have an expected salvage value of $10,000 at the end of its useful life of 10 years. Its annual O&M costs will be $50,000. If MARR is 20%, determine when the defender should be replaced. Assume that the estimates of the installed first cost and salvage value of the challenger are going to remain constant.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Lets break down the costs and benefits for both the defender and the challenger Defender Initial cos...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started