Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assume that all amounts in the case study are GST exclusive. Background Michelle Ricci and Sam Russo are cousins. They grew up in an

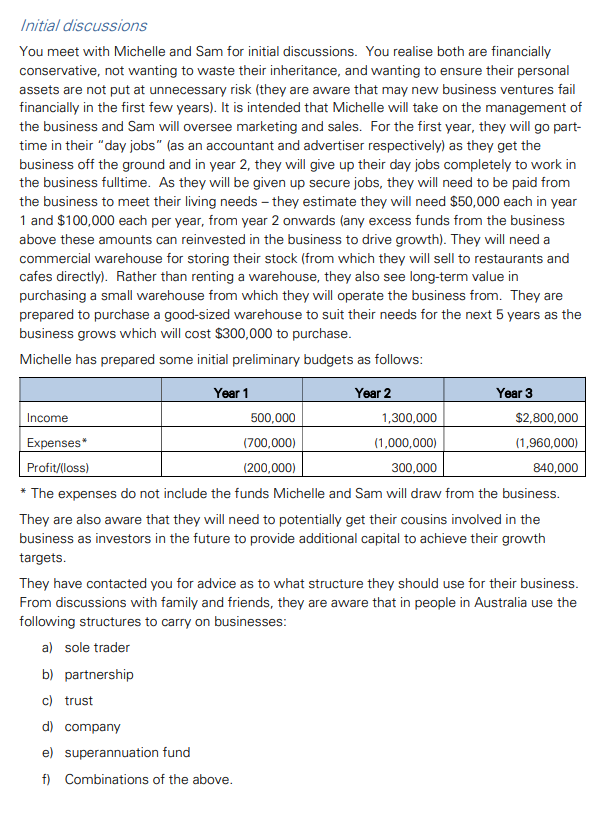

Assume that all amounts in the case study are GST exclusive. Background Michelle Ricci and Sam Russo are cousins. They grew up in an extended family of small business owners, watching the dedication and hardship of their parents and uncles and aunties running restaurants and other food related businesses. Now in their late 30's, they have decided to combined their passion for food with their Italian heritage, to start a business (with a working title Ricci Russo), selling speciality/high-end Italian food and ingredients (pastas, sauces, herbs, olives etc) to restaurants and cafes (from the families' long association with restaurants, they are confident there is a gap in the market for these products). They will use savings and money they inherited from their grandparents ($500,000 each) to fund their new venture. Michelle and Sam asked two of their other cousins if they would like to join them in the business, but these two cousins are not quite ready to join. Michelle studied accounting and went to work as a chartered accountant in a tax firm. She currently earns $190,000 per year. Michelle is married with two small children and her husband (lan) is also an accountant. They own their own home (with a mortgage). Michelle and lan have approximately $400,000 in superannuation (currently in a retail fund). Sam completed a marketing degree and works for an advertiser. He currently earns $140,000 per year. Sam is still single but has plans to start a family someday. Sam also owns his home (with a mortgage). Sam's parents are older than Michelle's and Sam provides his parents some financial support. Sam has approximately $250,000 in superannuation (in a retail fund). They have come to you for advice on how to best structure their new business. Initial discussions You meet with Michelle and Sam for initial discussions. You realise both are financially conservative, not wanting to waste their inheritance, and wanting to ensure their personal assets are not put at unnecessary risk (they are aware that may new business ventures fail financially in the first few years). It is intended that Michelle will take on the management of the business and Sam will oversee marketing and sales. For the first year, they will go part- time in their "day jobs" (as an accountant and advertiser respectively) as they get the business off the ground and in year 2, they will give up their day jobs completely to work in the business fulltime. As they will be given up secure jobs, they will need to be paid from the business to meet their living needs - they estimate they will need $50,000 each in year 1 and $100,000 each per year, from year 2 onwards (any excess funds from the business above these amounts can reinvested in the business to drive growth). They will need a commercial warehouse for storing their stock (from which they will sell to restaurants and cafes directly). Rather than renting a warehouse, they also see long-term value in purchasing a small warehouse from which they will operate the business from. They are prepared to purchase a good-sized warehouse to suit their needs for the next 5 years as the business grows which will cost $300,000 to purchase. Michelle has prepared some initial preliminary budgets as follows: Income Expenses* Profit/(loss) Year 1 500,000 (700,000) (200,000) Year 2 Year 3 1,300,000 $2,800,000 (1,000,000) (1,960,000) 300,000 840,000 * The expenses do not include the funds Michelle and Sam will draw from the business. They are also aware that they will need to potentially get their cousins involved in the business as investors in the future to provide additional capital to achieve their growth targets. They have contacted you for advice as to what structure they should use for their business. From discussions with family and friends, they are aware that in people in Australia use the following structures to carry on businesses: a) sole trader b) partnership c) trust d) company e) superannuation fund f) Combinations of the above. Requirements Prepare a letter of advice to Michelle and Sam advising them on the options to structure their new business, Ricci Russo, including analysis of each of the potential structures listed above with regard to: i. ii. iii. iv. Appropriateness of the structure for their fact pattern; Flexibility to deal with growth and react to change (both the business and personally); Tax effectiveness, including in relation to they will draw funds from the business to live on; and Asset protection against legal liability. Your answers should analyse each potential structure against these criteria and then reach a conclusions on which structure/s you would recommend. Your answers should include appropriate legislative, case or ruling references.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started