Answered step by step

Verified Expert Solution

Question

1 Approved Answer

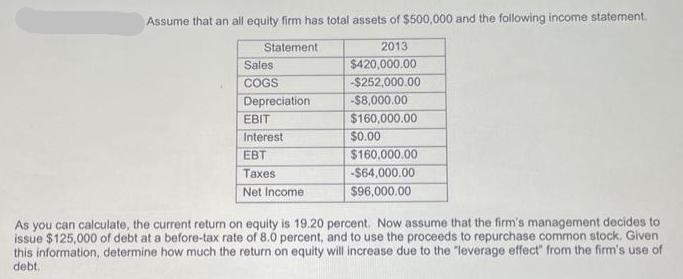

Assume that an all equity firm has total assets of $500,000 and the following income statement. Statement. 2013 $420,000.00 -$252,000.00 -$8,000.00 $160,000.00 $0.00 $160,000.00

Assume that an all equity firm has total assets of $500,000 and the following income statement. Statement. 2013 $420,000.00 -$252,000.00 -$8,000.00 $160,000.00 $0.00 $160,000.00 -$64,000.00 $96,000.00 Sales COGS Depreciation EBIT Interest EBT Taxes Net Income As you can calculate, the current return on equity is 19.20 percent. Now assume that the firm's management decides to issue $125,000 of debt at a before-tax rate of 8.0 percent, and to use the proceeds to repurchase common stock. Given this information, determine how much the return on equity will increase due to the "leverage effect" from the firm's use of debt.

Step by Step Solution

★★★★★

3.40 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

To determine how much the return on equity ROE will increase due to the leverage effect from the fir...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started