Question

Assume that an investor acquired a small retail property five years ago at a cost of $200,000. The Apex Center was 15 years old at

Assume that an investor acquired a small retail property five years ago at a cost of $200,000. The Apex Center was 15 years old at the time of purchase and was financed with a 75% mortgage made at 11% interest for 25 years. The investor uses straight line depreciation with 80% of the original price cost allocated to building and 20% to land. Assume at the time of purchase the property could be depreciated for 19 years. The marginal tax rate is 50% and the capital gain tax is 28%. The property could be sold for 250,000 today less the selling costs of 6%. If the property is sold at year 10 it would fetch 289,819 before selling costs of 6%. Assume the Apex center investor decided to renovate at an additional cost of 200,000 financed 75% by loan and equity 25% at interest rate of 11% for 15 years. The NOI in year 6 after renovation is 45,000 and thereafter growing at 4% per year. The property may be sold at end of year 10 at 547,494 before selling costs of 6%.

Required:

Compute the IRR on incremental cash flows. Is the additional investment to renovate Apex viable?

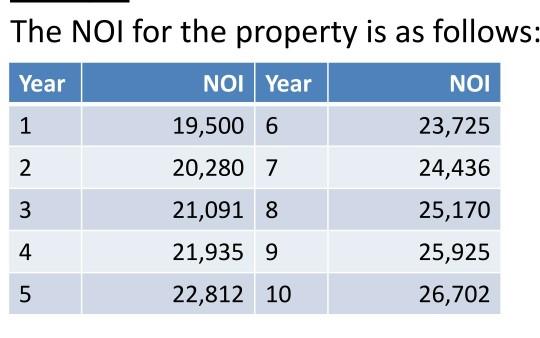

The NOI for the property is as follows: Year NOI Year NOI 1 19,500 6 23,725 2 20,280 7 24,436 3 21,091 8 25,170 4 21,935 9 25,925 5 22,812 10 26,702

Step by Step Solution

3.28 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Answer IRR 176 Explanation Years 5 0 6 1 7 2 8 3 9 4 10 5 ATCF with renovation 100000 5545 6578 7632 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started