Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assume that Apex Solutions has a stock-option plan for top management. Each stock option represents the right to purchase a share of Apex $1

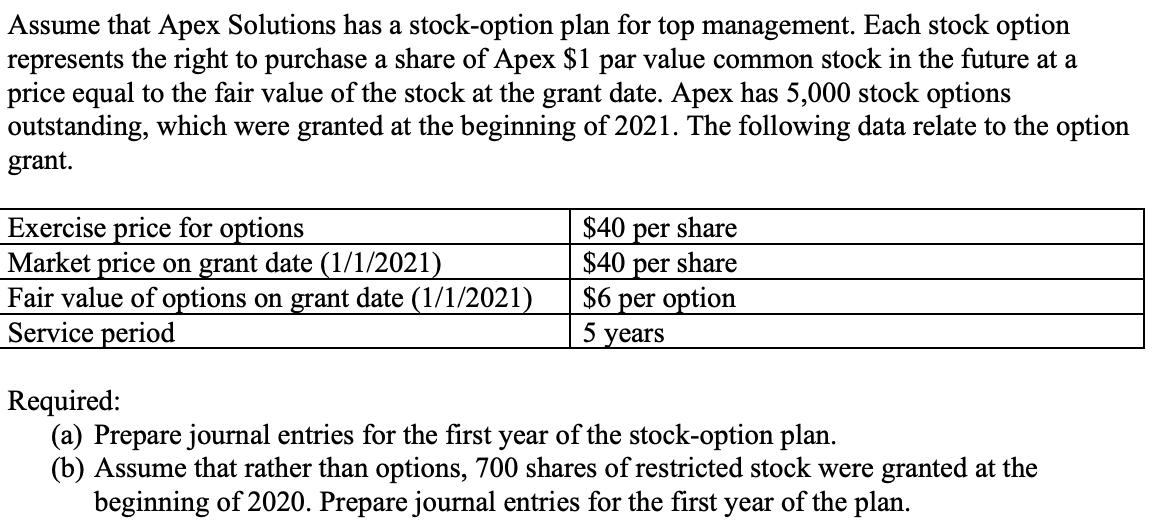

Assume that Apex Solutions has a stock-option plan for top management. Each stock option represents the right to purchase a share of Apex $1 par value common stock in the future at a price equal to the fair value of the stock at the grant date. Apex has 5,000 stock options outstanding, which were granted at the beginning of 2021. The following data relate to the option grant. Exercise price for options $40 per share Market price on grant date (1/1/2021) $40 per share Fair value of options on grant date (1/1/2021) $6 per option Service period years Required: (a) Prepare journal entries for the first year of the stock-option plan. (b) Assume that rather than options, 700 shares of restricted stock were granted at the beginning of 2020. Prepare journal entries for the first year of the plan.

Step by Step Solution

★★★★★

3.54 Rating (144 Votes )

There are 3 Steps involved in it

Step: 1

a 112020 No entry 12312020 5 Options b 112020 700 Cr Common ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started