Question

Assume that as of 13 July 2009, Google had no debt or cash. The firms managers consider recapitalising the firm by issuing zero-coupon debt with

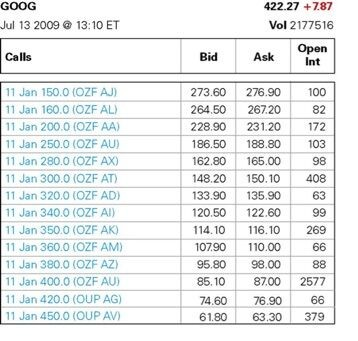

Assume that as of 13 July 2009, Google had no debt or cash. The firms managers consider recapitalising the firm by issuing zero-coupon debt with a face value of $96 billion due in January of 2011, and using the proceeds to repurchase shares. Assume that before issuing the debt, Google had 320 million shares outstanding and a market capitalisation of $135.126 billion. Use the option data from July 13, 2009 in the following figure to determine Googles firm value after debt issuance, equity value after debt issuance, market value of debt and cost of debt. Hint: Assume perfect capital markets. That is debt issuance does not affect the total value of the firm. Use the mid-point of bid and ask as the call value. Show your detailed steps and result in your submission.

GOOG 422.27 +787 Jul 13 2009@ 13:10 ET Vol 2177516 Open Int Calls Bid Ask 11 Jan 150.0 (OZF AJ) 11 Jan 160.0 (OZF AL) 11 Jan 200.0 (0ZF AA) 11 Jan 250.0 (OZF AU) 11 Jan 280.0 (OZF AX) 11 Jan 300.0 (OZF AT) 273.60 276.90 100 264.50 267.20 82 228.90 231.20 172 188.80 186.50 103 165.00 162.80 98 148.20 150.10 408 11 Jan 320.0 (OZF AD) 133.90 135.90 63 11 Jan 340.0 (OZF AI) 120.50 122.60 99 11 Jan 350.0 (OZF AK) 114.10 116.10 269 11 Jan 360.0 (OZF AM) 11 Jan 380.0 (OZF AZ) 11 Jan 400.0 (OZF AU) 110.00 10790 66 95.80 98.00 88 85.10 87.00 2577 11 Jan 420.0 (OUP AG) 74.60 76.90 66 11 Jan 450.0 (OUP AV) 379 61.80 63.30

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started