Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assume that as of 15 Jan 2020, Company A had no debt or cash. The firm?s managers consider recapitalising the firm by issuing zero-coupon debt

Assume that as of 15 Jan 2020, Company A had no debt or cash. The firm?s managers consider recapitalising the firm by issuing zero-coupon debt with a face value of $30 billion due in Jul of 2022, and using the proceeds to repurchase shares. Assume that before issuing the debt, Company A had 545.45 million shares outstanding and a market capitalisation of $34.91 billion. Assume perfect capital markets.

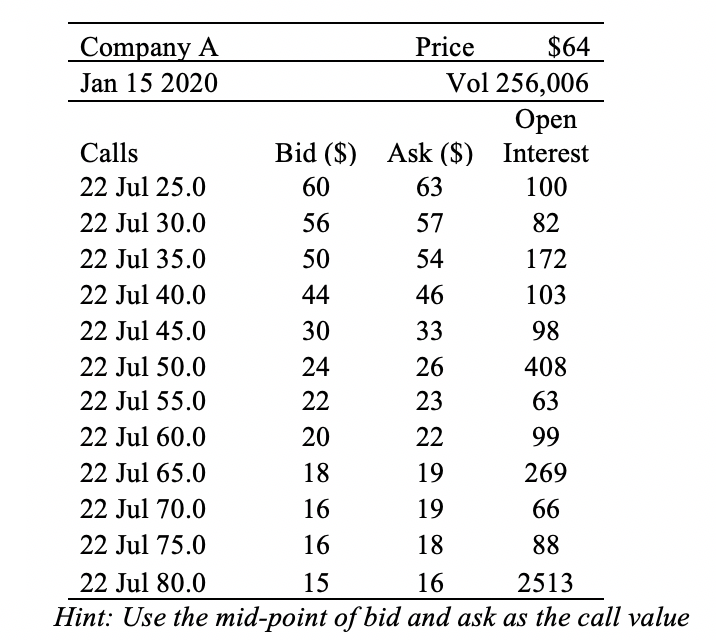

Use the option data from 15 Jan, 2020 in the following figure to determine Company A's firm value after debt issuance:

Company A Jan 15 2020 Calls 22 Jul 25.0 22 Jul 30.0 22 Jul 35.0 22 Jul 40.0 22 Jul 45.0 22 Jul 50.0 22 Jul 55.0 22 Jul 60.0 22 Jul 65.0 22 Jul 70.0 22 Jul 75.0 Bid ($) 60 56 50 44 30 24 22 20 18 16 16 15 $64 Vol 256,006 Open Interest 100 82 172 103 98 408 63 99 269 66 88 Price Ask ($) 63 57 54 46 33 26 23 22 19 19 18 22 Jul 80.0 16 2513 Hint: Use the mid-point of bid and ask as the call value

Step by Step Solution

★★★★★

3.48 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below The firm va...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started