Question

Assume that both banks offer an annual rate of 3% on checking deposits and charge an annual rate of 5% on loans. For Small Bank,

Assume that both banks offer an annual rate of 3% on checking deposits and charge an annual rate of 5% on loans.

Assume that both banks offer an annual rate of 3% on checking deposits and charge an annual rate of 5% on loans.

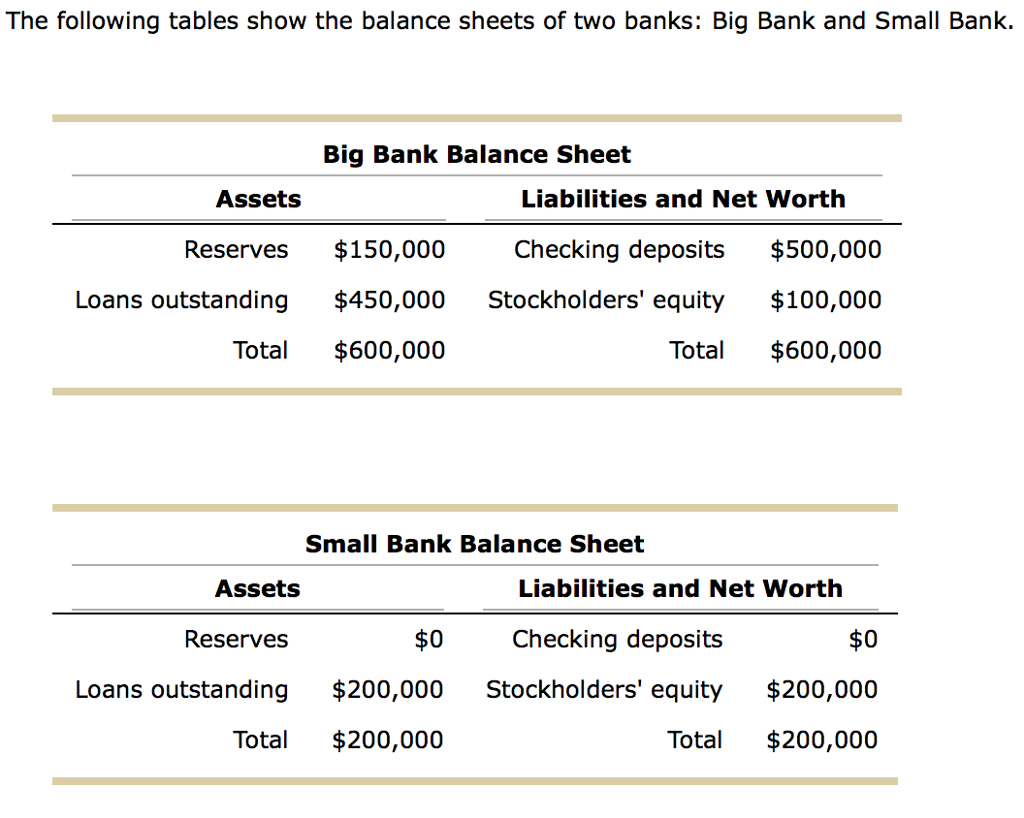

For Small Bank, the annual interest cost on deposits is__________, and the annual return on loans is __________. Hence, Small Bank earns a net profit of ________, which represents a rate of return of __________ % (Hint: Round to 1 decimal place.) on stockholders' equity.

For Big Bank, the annual interest cost on deposits is _________, and the annual return on loans is ____________. Hence, Big Bank earns a net profit of __________, which represents a rate of return of __________% (Hint: Round to 1 decimal place.) on stockholders' equity.

Suppose that the value of loans in both banks declines by 10%. The amount of loans outstanding for Big Bank decreases from $450,000 to __________, which represents a loss of _____________% (Hint: Round to 1 decimal place.) of stockholders' equity. The amount of loans outstanding for Small Bank decreases from $200,000 to ___________, which represents a loss of___________% (Hint: Round to 1 decimal place.) of stockholders' equity.

Therefore, (BIG/SMALL) provides a higher rate of return to its investors, and (BIG/SMALL) exposes its investors to greater risk in the event of a decline in the value of loans.

The following tables show the balance sheets of two banks: Big Bank and Small Bank. Big Bank Balance Sheet Assets Liabilities and Net Worth Reserves $150,000 Checking deposits $500,000 Loans outstanding $450,000 Stockholders' equity $100,000 Total $600,000 Total $600,000 Small Bank Balance Sheet Assets Liabilities and Net Worth $0 Loans outstanding $200,000 Stockholders' equity $200,000 Total $200,000 Reserves $0 Checking deposits Total $200,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started