Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assume that each employee contrnibutes $14 per week for union dues. The bookkeeper for Pinto Co. of Peterborough gathered the following data from employee

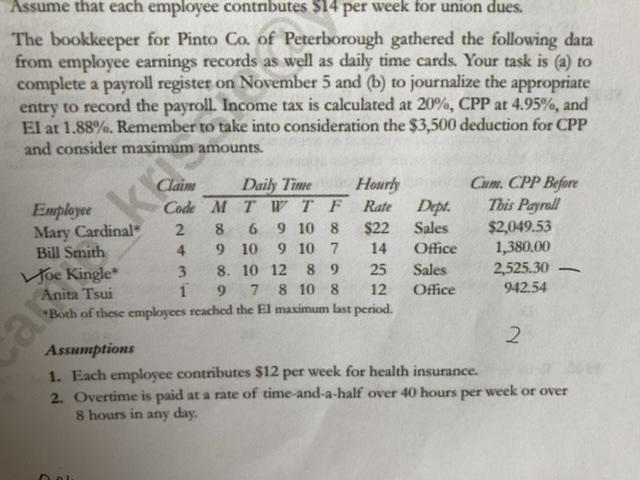

Assume that each employee contrnibutes $14 per week for union dues. The bookkeeper for Pinto Co. of Peterborough gathered the following data from employee earnings records as well as daily time cards. Your task is (a) to complete a payroll register on November 5 and (b) to journalize the appropriate entry to record the payroll. Income tax is calculated at 20%, CPP at 4.95%, and El at 1.88%. Remember to take into consideration the $3,500 deduction for CPP and consider maximum amounts. Cum. CPP Before This Payroll Daily Time Code M T W TFRate 9 10 8 9 10 7 8 9 7 8 10 8 Hourly Dept. Sales Claim Employee Mary Cardinal Bill Smith $2,049.53 1,380.00 2,525.30 2 8 6. $22 9 10 8. 10 12 4 14 Office 25 Sales Voe Kingle* Anita Tsui Both of these employees reached the El maximum last period. 3. 9. 12 Office 942.54 2. Assumptions 1. Each employee contributes $12 per week for health insurance. 2. Overtime is paid at a rate of time-and-a-half over 40 hours per week or over 8 hours in any day.

Step by Step Solution

★★★★★

3.46 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Payroll Daily Wage Employee Claim Code M T w T F Total hours Normal hours OT hours Hourly r...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started