Answered step by step

Verified Expert Solution

Question

1 Approved Answer

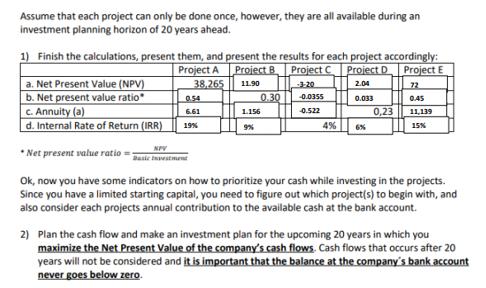

Assume that each project can only be done once, however, they are all available during an investment planning horizon of 20 years ahead. 1)

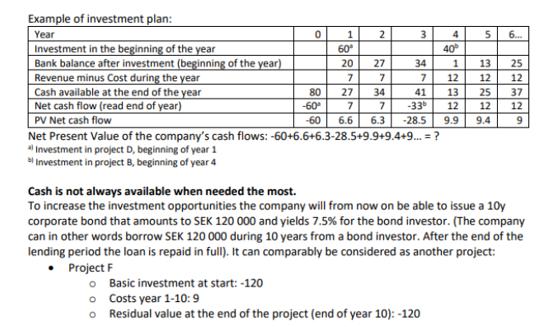

Assume that each project can only be done once, however, they are all available during an investment planning horizon of 20 years ahead. 1) Finish the calculations, present them, and present the results for each project accordingly: Project A Project B Project D Project E 38.265 11.90 2.04 0.033 a. Net Present Value (NPV) b. Net present value ratio 0.54 c. Annuity (a) 6.61 d. Internal Rate of Return (IRR) 19% NPV Basic Investment 0.30 1.156 9% Project C 3-20 -0.0355 -0.522 4% 6% 0,23 72 0.45 11,139 15% *Net present value ratio= Ok, now you have some indicators on how to prioritize your cash while investing in the projects. Since you have a limited starting capital, you need to figure out which project(s) to begin with, and also consider each projects annual contribution to the available cash at the bank account. 2) Plan the cash flow and make an investment plan for the upcoming 20 years in which you maximize the Net Present Value of the company's cash flows. Cash flows that occurs after 20 years will not be considered and it is important that the balance at the company's bank account never goes below zero. Example of investment plan: Year Investment in the beginning of the year Bank balance after investment (beginning of the year) Revenue minus Cost during the year Cash available at the end of the year Net cash flow (read end of year) PV Net cash flow 0 80 -60 -60 1 60 20 7 27 7 2 27 7 34 7 6.3 3 cl 34 Ele 4 7 12 40 6.6 Net Present Value of the company's cash flows: -60+6.6+6.3-28.5+9.9+9.4+9...= ? *Investment in project D, beginning of year 1 * Investment in project 8, beginning of year 4 N o Basic investment at start: -120 o Costs year 1-10: 9 o Residual value at the end of the project (end of year 10): -120 1 13 25 mle 5 41 13 25 37 HI N|W 12 -33b -28.5 9.9 9.4 12 12 S|N|5 6... 12 w 12 9 Cash is not always available when needed the most. To increase the investment opportunities the company will from now on be able to issue a 10y corporate bond that amounts to SEK 120 000 and yields 7.5% for the bond investor. (The company can in other words borrow SEK 120 000 during 10 years from a bond investor. After the end of the lending period the loan is repaid in full). It can comparably be considered as another project: Project F

Step by Step Solution

★★★★★

3.29 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

To create an investment plan for the upcoming 20 years and maximize the Net Present Value NPV of the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started