Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assume that E(rM) = 8% and rf= 2%. use the data provided to calculate the following Amgen's variables as of year-end 2015. a. Calculate Amgen's

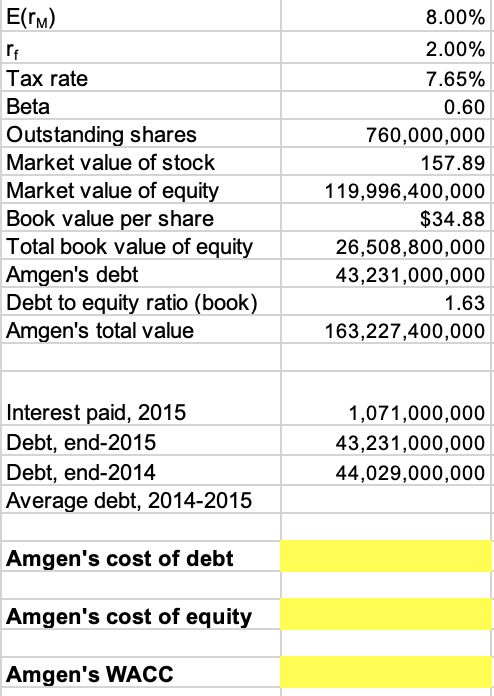

Assume that E(rM) = 8% and rf= 2%. use the data provided to calculate the following Amgen's variables as of year-end 2015.

Assume that E(rM) = 8% and rf= 2%. use the data provided to calculate the following Amgen's variables as of year-end 2015.

a. Calculate Amgen's cost of debt.

b. Calculate Amgen's cost of equity.

c. What is Amgen's WACC?

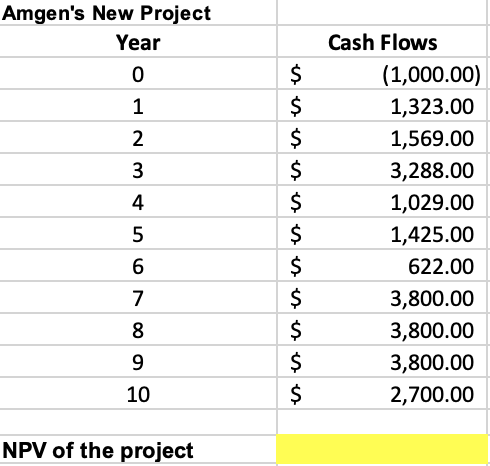

d. Given the cash flows of a potential project Amgen is considering, what is the NPY of the project?

Amgen's New Project \begin{tabular}{|c|cc|} \hline Year & \multicolumn{2}{c|}{ Cash Flows } \\ \hline 0 & $ & (1,000.00) \\ \hline 1 & $ & 1,323.00 \\ \hline 2 & $ & 1,569.00 \\ \hline 3 & $ & 3,288.00 \\ \hline 4 & $ & 1,029.00 \\ \hline 5 & $ & 1,425.00 \\ \hline 6 & $ & 622.00 \\ \hline 7 & $ & 3,800.00 \\ \hline 8 & $ & 3,800.00 \\ \hline 9 & $ & 3,800.00 \\ \hline 10 & $ & 2,700.00 \\ \hline \end{tabular} NPV of the project \begin{tabular}{l|r} E(rM) & 8.00% \\ \hlinerf & 2.00% \\ \hline Tax rate & 7.65% \\ \hline Beta & 0.60 \\ \hline Outstanding shares & 760,000,000 \\ \hline Market value of stock & 157.89 \\ \hline Market value of equity & 119,996,400,000 \\ \hline Book value per share & $34.88 \\ \hline Total book value of equity & 26,508,800,000 \\ \hline Amgen's debt & 43,231,000,000 \\ \hline Debt to equity ratio (book) & 1.63 \\ \hline Amgen's total value & 163,227,400,000 \\ \hline \end{tabular} \begin{tabular}{|r|r|} \hline Interest paid, 2015 & 1,071,000,000 \\ \hline Debt, end-2015 & 43,231,000,000 \\ \hline Debt, end-2014 & 44,029,000,000 \\ \hline \end{tabular} Average debt, 2014-2015 Amgen's cost of debt Amgen's cost of equity Amgen's WACCStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started