Question

Assume that Fake Stone, Inc. is operating at full capacity. Also assume that assets, costs, and current liabilities vary directly with sales. The dividend payout

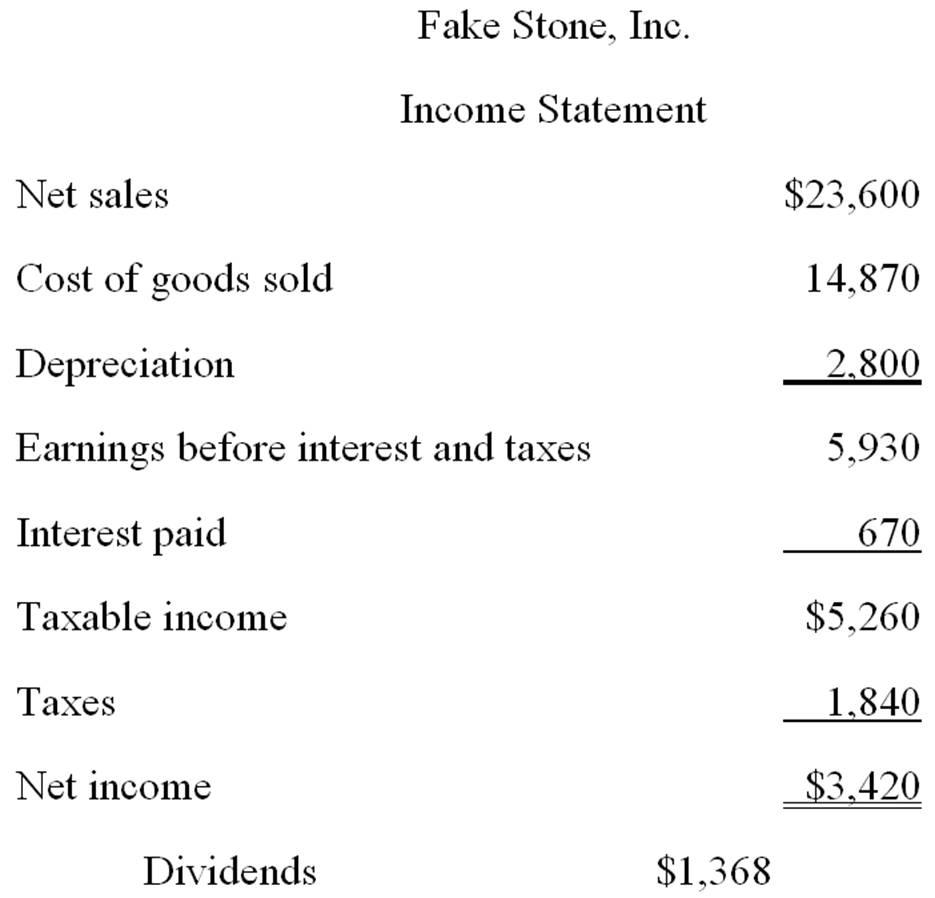

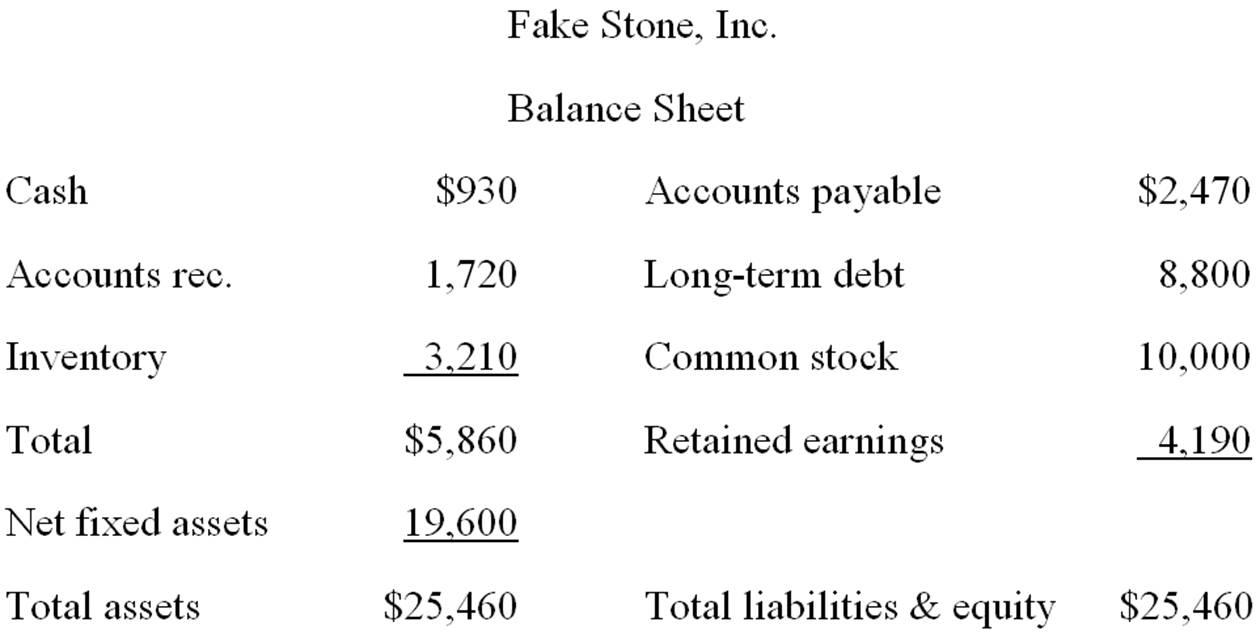

Assume that Fake Stone, Inc. is operating at full capacity. Also assume that assets, costs, and current liabilities vary directly with sales. The dividend payout ratio is constant. The Company’s sales manager estimates that sales will increase by 12% next year.

a) Prepare a pro-forma balance sheet

b) What are the external financing needs under these assumptions?

Fake Stone, Inc. Income Statement Net sales $23,600 Cost of goods sold 14,870 Depreciation 2,800 Earnings before interest and taxes 5,930 Interest paid 670 Taxable income $5,260 Taxes Net income 1,840 $3.420 Dividends $1,368

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To prepare a proforma balance sheet and determine the external financing needs for Fake Stone Inc well follow these steps 1 Calculate the new level of sales after a 12 increase 2 Assuming assets costs ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Management Theory and Practice

Authors: Eugene Brigham, Michael Ehrhardt, Jerome Gessaroli, Richard Nason

2nd Canadian edition

176517308, 978-0176517304

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App