Question

Assume that Farine Company has impressed you since you first heard of the company. You learn of a staff opening at Farine Company and

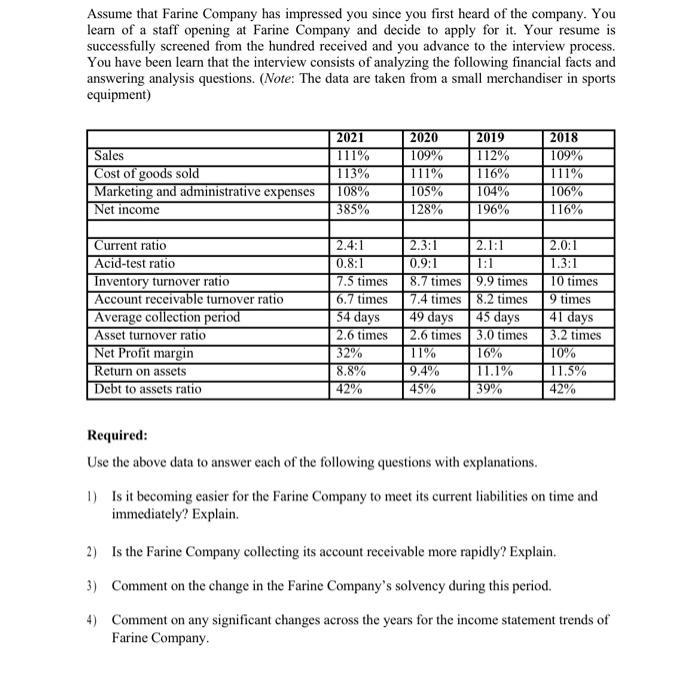

Assume that Farine Company has impressed you since you first heard of the company. You learn of a staff opening at Farine Company and decide to apply for it. Your resume is successfully screened from the hundred received and you advance to the interview process. You have been learn that the interview consists of analyzing the following financial facts and answering analysis questions. (Note: The data are taken from a small merchandiser in sports equipment) 2021 2020 2019 2018 Sales 111% 109% 112% 109% Cost of goods sold 113% 111% 116% 111% 108% 105% 104% 106% Marketing and administrative expenses Net income 385% 128% 196% 116% Current ratio 2.4:1 2.3:1 2.1:1 2.0:1 Acid-test ratio 0.8:1 0.9:1 1:1 1.3:1 10 times Inventory turnover ratio 7.5 times 8.7 times 9.9 times Account receivable turnover ratio 6.7 times 7.4 times 8.2 times Average collection period 54 days 49 days 45 days 9 times 41 days 3.2 times Asset turnover ratio 2.6 times 2.6 times 3.0 times Net Profit margin 32% 11% 16% 10% Return on assets 8.8% 9.4% 11.1% 11.5% Debt to assets ratio 42% 45% 39% 42% Required: Use the above data to answer each of the following questions with explanations. 1) Is it becoming easier for the Farine Company to meet its current liabilities on time and immediately? Explain. 2) Is the Farine Company collecting its account receivable more rapidly? Explain. 3) Comment on the change in the Farine Company's solvency during this period. 4) Comment on any significant changes across the years for the income statement trends of Farine Company.

Step by Step Solution

3.41 Rating (132 Votes )

There are 3 Steps involved in it

Step: 1

Answer1 Whether current liabilities are being met timely and immediately can be judged by the two li...

Get Instant Access with AI-Powered Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started