Question

Assume that Firm A is an all-equity firm with total assets of $5,000 and the following distribution of EBIT for the coming year: Firm

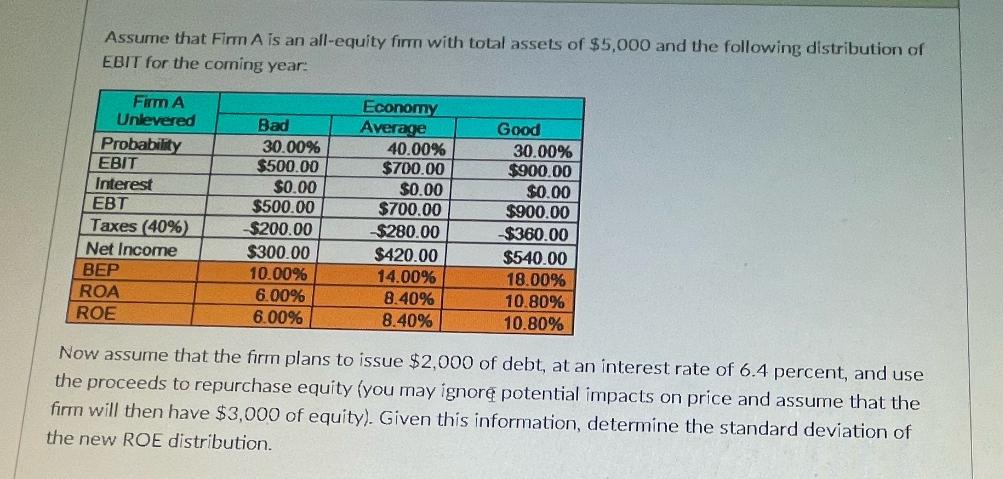

Assume that Firm A is an all-equity firm with total assets of $5,000 and the following distribution of EBIT for the coming year: Firm A Unlevered Bad Economy Average Good Probability 30.00% 40.00% 30.00% EBIT $500.00 $700.00 $900.00 Interest $0.00 $0.00 $0.00 EBT $500.00 $700.00 $900.00 Taxes (40%) -$200.00 $280.00 -$360.00 Net Income $300.00 $420.00 $540.00 BEP 10.00% 14.00% 18.00% ROA 6.00% 8.40% 10.80% ROE 6.00% 8.40% 10.80% Now assume that the firm plans to issue $2,000 of debt, at an interest rate of 6.4 percent, and use the proceeds to repurchase equity (you may ignore potential impacts on price and assume that the firm will then have $3,000 of equity). Given this information, determine the standard deviation of the new ROE distribution.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To determine the standard deviation of the new ROE distribution after Firm A issues 2000 of debt and ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial and Managerial Accounting

Authors: Horngren, Harrison, Oliver

3rd Edition

978-0132497992, 132913771, 132497972, 132497999, 9780132913775, 978-0132497978

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App