Answered step by step

Verified Expert Solution

Question

1 Approved Answer

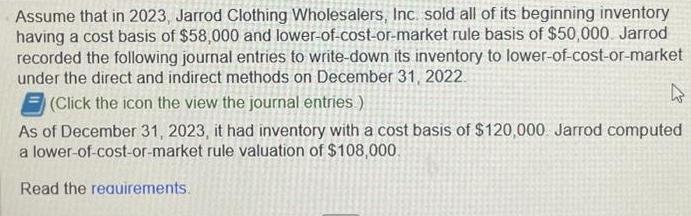

Assume that in 2023, Jarrod Clothing Wholesalers, Inc. sold all of its beginning inventory having a cost basis of $58,000 and lower-of-cost-or-market rule basis

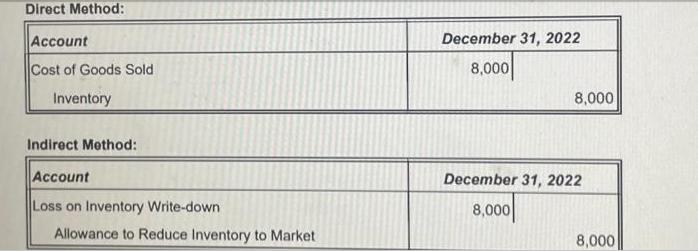

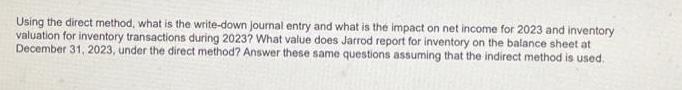

Assume that in 2023, Jarrod Clothing Wholesalers, Inc. sold all of its beginning inventory having a cost basis of $58,000 and lower-of-cost-or-market rule basis of $50,000. Jarrod recorded the following journal entries to write-down its inventory to lower-of-cost-or-market under the direct and indirect methods on December 31, 2022 (Click the icon the view the journal entries) As of December 31, 2023, it had inventory with a cost basis of $120,000 Jarrod computed a lower-of-cost-or-market rule valuation of $108,000 Read the requirements. Direct Method: Account Cost of Goods Sold Inventory Indirect Method: Account Loss on Inventory Write-down Allowance to Reduce Inventory to Market December 31, 2022 8,000 8,000 December 31, 2022 8,000 8,000 Using the direct method, what is the write-down journal entry and what is the impact on net income for 2023 and inventory valuation for inventory transactions during 2023? What value does Jarrod report for inventory on the balance sheet at December 31, 2023, under the direct method? Answer these same questions assuming that the indirect method is used. Assume that in 2023, Jarrod Clothing Wholesalers, Inc. sold all of its beginning inventory having a cost basis of $58,000 and lower-of-cost-or-market rule basis of $50,000. Jarrod recorded the following journal entries to write-down its inventory to lower-of-cost-or-market under the direct and indirect methods on December 31, 2022 (Click the icon the view the journal entries) As of December 31, 2023, it had inventory with a cost basis of $120,000 Jarrod computed a lower-of-cost-or-market rule valuation of $108,000 Read the requirements. Direct Method: Account Cost of Goods Sold Inventory Indirect Method: Account Loss on Inventory Write-down Allowance to Reduce Inventory to Market December 31, 2022 8,000 8,000 December 31, 2022 8,000 8,000 Using the direct method, what is the write-down journal entry and what is the impact on net income for 2023 and inventory valuation for inventory transactions during 2023? What value does Jarrod report for inventory on the balance sheet at December 31, 2023, under the direct method? Answer these same questions assuming that the indirect method is used.

Step by Step Solution

★★★★★

3.40 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Direct Method Date December 31 2022 Debit Cost of Goods Sold Ac 8000 Credit Inventory Reserve Ac 800...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started