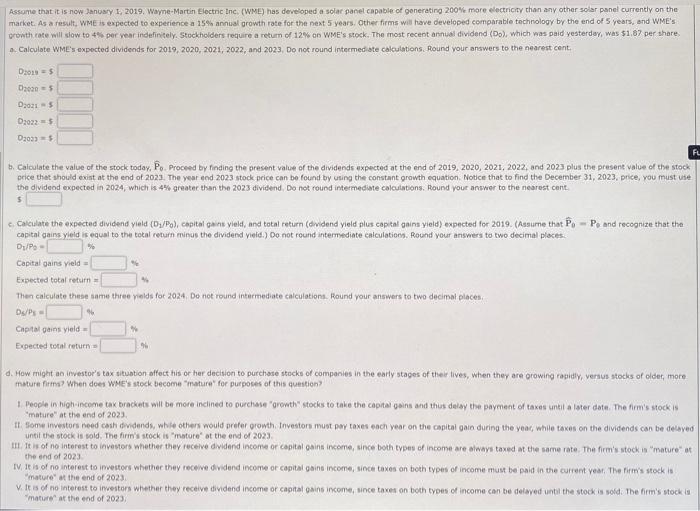

Assume that it is now January 1, 2019, Wayne-Martin Electric Inc. (WME) has developed a solar panel capable of generating 200% more electricity than any other solar panel currently on the market. As a result, WME is expected to experience a 15% annual growth rate for the next 5 years. Other firms will have developed comparable technology by the end of 5 years, and WME's growth rate will slow to 4 per year indefinitely. Stockholders require a return of 12% on WME's stock. The most recent annual dividend (Do), which was paid yesterday, was $1.67 per share. Calculate WME's expected dividends for 2019, 2020, 201, 2022 and 2023. Do not round intermediate calculations. Round your answers to the nearest cent. D2019 - 5 020205 D20215 D20225 02035 F. b. Calculate the value of the stock today, Po Proceed by finding the present value of the dividends expected at the end of 2019, 2020, 2021, 2022, and 2025 plus the present value of the stock price that should exist at the end of 2023. The year end 2023 stock price can be found by using the constant growth equation Notice that to find the December 31, 2023. price, you must use the dividend expected in 2024, which is 4% greater than the 2023 dividend. Do not round intermediate calculations. Round your answer to the nearest cent 5 Calculate the expected dividend yield (DL/P), capital cains yield, and total return (dividend yield plus capital gains yield) expected for 2019. (Assume that P.-P. and recognize that the capital gains yield is equal to the total return minus the dividend yield.) Do not round intermediate calculations. Round your answers to two decimal places D/P - % Capital gains yield Expected total return Then calculate these are three mields for 2024. Do not round intermediate calculations. Round your answers to two decimal places Ds/PE - Capital gains yield- Expected total return d. How might an investor's tax situation effect his or her decision to purchase stocks of companies in the early stages of their lives, when they are growing rapidly versus stocks of older, more mature fit? When does WHE's stock become mature for purposes of this question 1. People in high income tax brackets will be more inclined to purchase prowth stocks to take the capital gains and thus delay the payment of taxes until later date. The firm's stock mature" at the end of 2023 11. Some investors need cash dividends, we others would prefer growth. Investors must pay taxes each year on the capital gato during the year, while taxes on the dividends can be delayed until the stock is sold. The firm's stock is mature at the end of 2023 IT It is of no interest to investors whether they receive dividend income or capital gains income, since both types of income are always taxed at the same rate. The firm's stock is "mature" at the end of 2023 IV. It is of no interest to investors whether they receive dividend income or capital gains income, since taxes on both types of income must be paid in the current year. The firm's stock is mature at the end of 2023 V. It is of no interest to inwestors whether they receive dividend income or capital gains income, since taxes on both types of income can be delayed until the stock is sold. The firm's stockis mature at the end of 2023