Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assume that Jeffrey has no other income and is unmarried, compute his chargeable income for YA2021 Net income Less: Partners' salaries: Partners' interest: Jackson Jeffrey

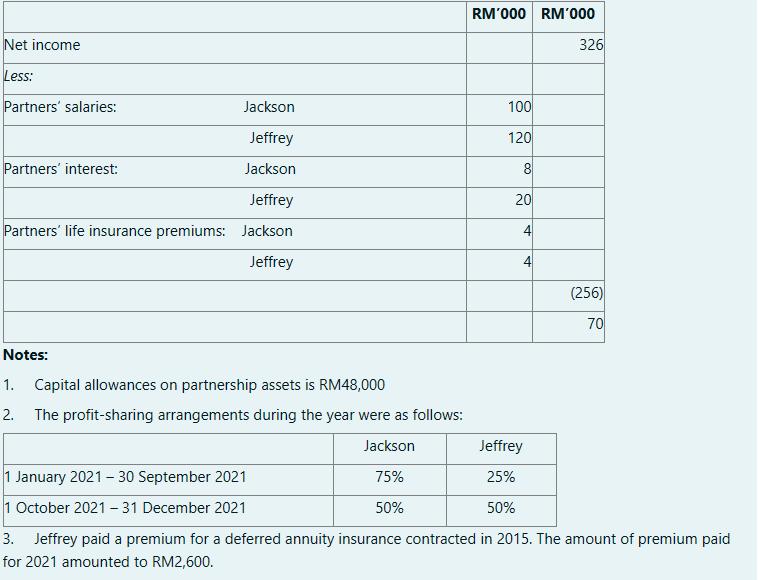

Assume that Jeffrey has no other income and is unmarried, compute his chargeable income for YA2021

Net income Less: Partners' salaries: Partners' interest: Jackson Jeffrey Jackson Jeffrey Partners' life insurance premiums: Jackson Jeffrey Notes: 1. Capital allowances on partnership assets is RM48,000 2. The profit-sharing arrangements during the year were as follows: Jackson 75% 50% RM'000 RM'000 100 120 8 20 4 A 326 (256) 70 Jeffrey 1 January 2021 - 30 September 2021 25% 1 October 2021-31 December 2021 50% 3. Jeffrey paid a premium for a deferred annuity insurance contracted in 2015. The amount of premium paid for 2021 amounted to RM2,600.

Step by Step Solution

★★★★★

3.34 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

To compute Jeffreys chargeable income for YA2021 we need to consider his net income and make adjustm...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started