Answered step by step

Verified Expert Solution

Question

1 Approved Answer

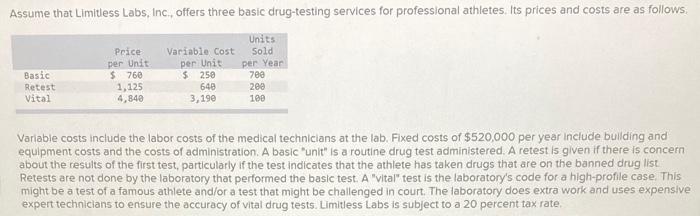

Assume that Limitless Labs, Inc., offers three basic drug-testing services for professional athletes. Its prices and costs are as follows. Basic Retest Vital Price

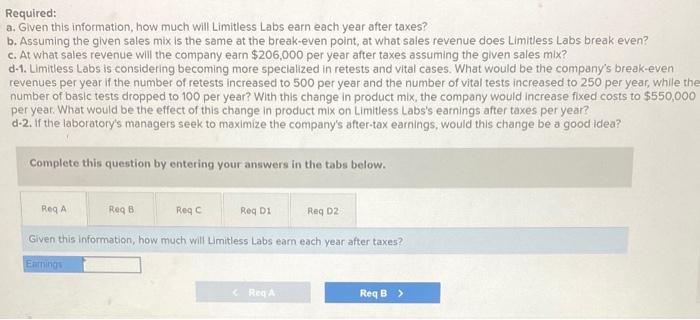

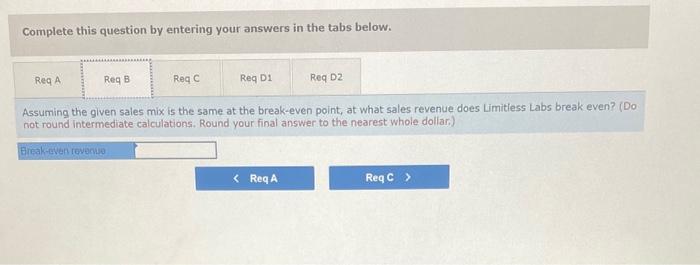

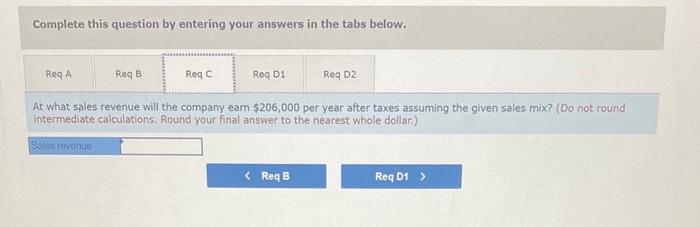

Assume that Limitless Labs, Inc., offers three basic drug-testing services for professional athletes. Its prices and costs are as follows. Basic Retest Vital Price per Unit. Variable Cost per Unit $ 250 Units Sold per Year 700 648 3,190 200 100 $ 760 1,125 4,840 Variable costs include the labor costs of the medical technicians at the lab. Fixed costs of $520,000 per year include building and equipment costs and the costs of administration. A basic "unit" is a routine drug test administered. A retest is given if there is concern about the results of the first test, particularly if the test indicates that the athlete has taken drugs that are on the banned drug list Retests are not done by the laboratory that performed the basic test. A "vital" test is the laboratory's code for a high-profile case. This might be a test of a famous athlete and/or a test that might be challenged in court. The laboratory does extra work and uses expensive expert technicians to ensure the accuracy of vital drug tests. Limitless Labs is subject to a 20 percent tax rate. Required: a. Given this information, how much will Limitless Labs earn each year after taxes? b. Assuming the given sales mix is the same at the break-even point, at what sales revenue does Limitless Labs break even? c. At what sales revenue will the company earn $206,000 per year after taxes assuming the given sales mix? d-1. Limitless Labs is considering becoming more specialized in retests and vital cases. What would be the company's break-even revenues per year if the number of retests increased to 500 per year and the number of vital tests increased to 250 per year, while the number of basic tests dropped to 100 per year? With this change in product mix, the company would increase fixed costs to $550,000 per year. What would be the effect of this change in product mix on Limitless Labs's earnings after taxes per year? d-2. If the laboratory's managers seek to maximize the company's after-tax earnings, would this change be a good idea? Complete this question by entering your answers in the tabs below. Req A Req Bi Req C Req Di Req D2 Given this information, how much will Limitless Labs earn each year after taxes? Earnings Complete this question by entering your answers in the tabs below. Req A Req B Req C Req D1 Req D2 Assuming the given sales mix is the same at the break-even point, at what sales revenue does Limitless Labs break even? (Do not round intermediate calculations. Round your final answer to the nearest whole dollar.) Break-even revenue < Req A ReqC > Complete this question by entering your answers in the tabs below. Req A Req B Req C Req D1 Req D2 At what sales revenue will the company earn $206,000 per year after taxes assuming the given sales mix? (Do not round intermediate calculations. Round your final answer to the nearest whole dollar.) Sales revenue Req A Req B Req C Req D1 Req D2 Limitless Labs is considering becoming more specialized in retests and vital cases. What would be the company's break-even revenues per year if the number of retests increased to 500 per year and the number of vital tests increased to 250 per year, while the number of basic tests dropped to 100 per year? With this change in product mix, the company would increase fixed costs to $550,000 per year. What would be the effect of this change in product mix on Limitless Labs's earnings after taxes per year? Show less A Earnings < ReqC Req D2 >

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started