Question

1 Assume that Lothbrok Industries exists in a Modigliani and Miller (MM) world with corporate taxes, but all other MM assumptions hold. Lothbrok forecasts that

1

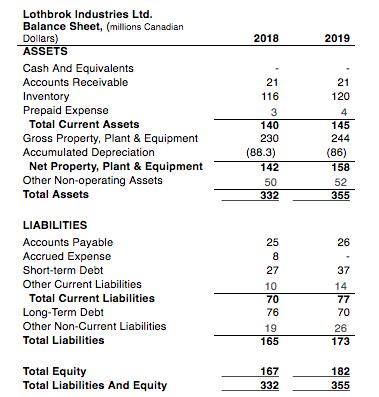

Assume that Lothbrok Industries exists in a "Modigliani and Miller" (MM) world with corporate taxes, but all other MM assumptions hold. Lothbrok forecasts that its EBIT will not grow in future years, that is, its most recent EBIT will become a perpetuity. Lothbrok has an unlevered cost of equity (rsU) of 10.2%, its cost of debt is 7.1% and its stock price is at $6.40. Assume the book value of short and long-term debt equals its market value. Using the above information and the financials provided on Lothbrok, calculate Lothbrok's cost of equity?

Question 2

Using information provided before (Question 1 and in Lothbrok’s financial statements), calculate the Value (VL) of Lothbrok Industries Ltd.

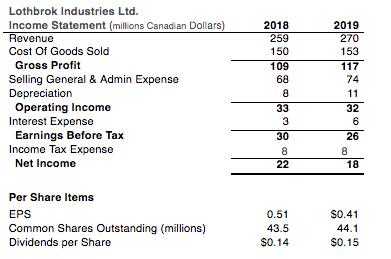

Lothbrok Industries Ltd. Income Statement (millions Canadian Dollars) Revenue Cost Of Goods Sold 2018 2019 259 270 150 153 Gross Profit 109 117 Selling General & Admin Expense Depreciation Operating Income Interest Expense Earnings Before Tax Income Tax Expense 68 74 8 11 33 32 3 6 30 26 8 8 Net Income 22 18 Per Share Items EPS 0.51 $0.41 Common Shares Outstanding (millions) Dividends per Share 43.5 44.1 $0.14 $0.15

Step by Step Solution

3.45 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

question 1 bebt cost of eqwiny undes HM appronch Ru tD RuRD bequsty ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started