Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assume that Madhusudan's Markets had an inventory balance of $32570 at the close of the last accounting period. The following sales and purchase transactions are

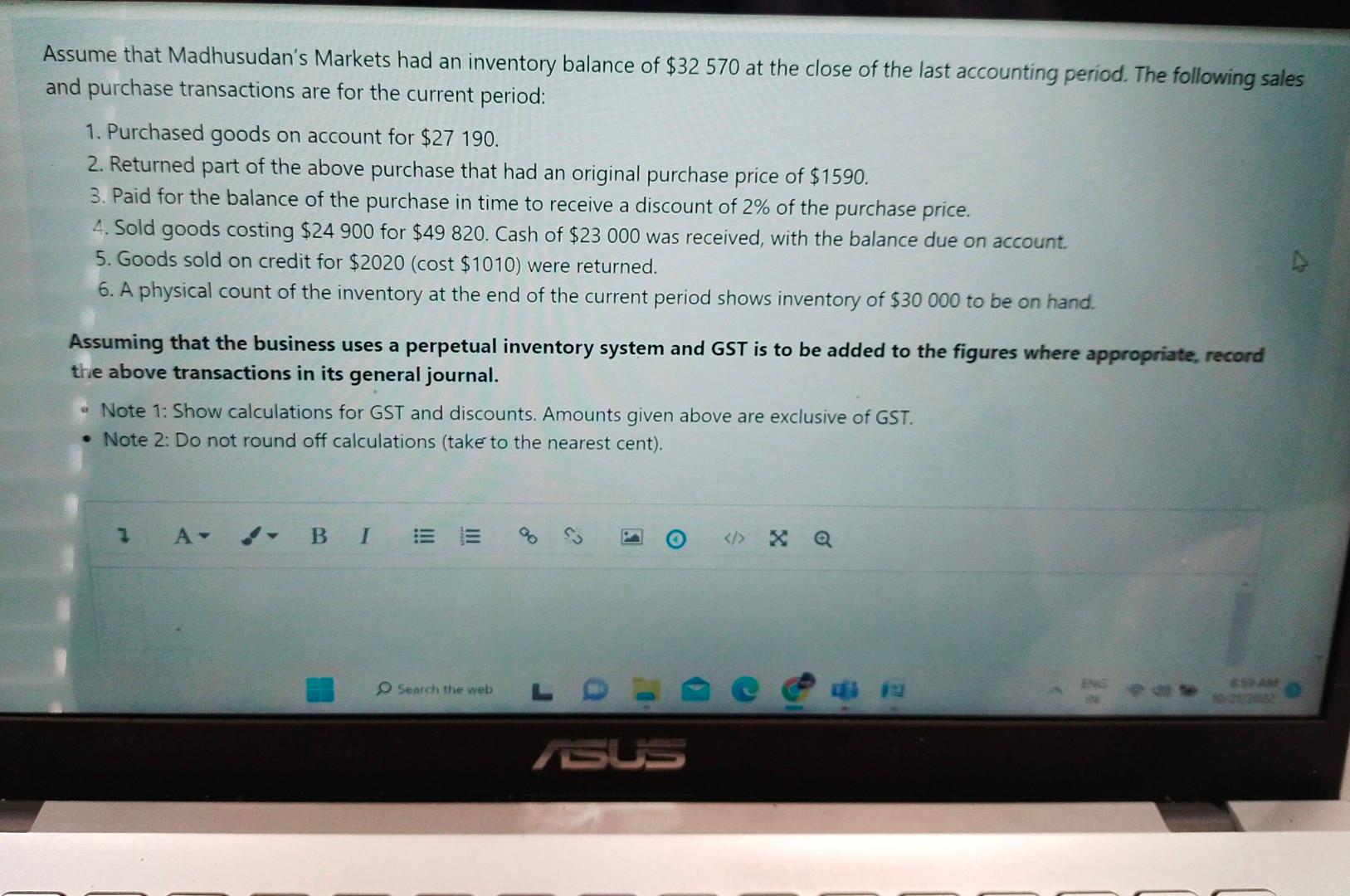

Assume that Madhusudan's Markets had an inventory balance of $32570 at the close of the last accounting period. The following sales and purchase transactions are for the current period: 1. Purchased goods on account for $27190. 2. Returned part of the above purchase that had an original purchase price of $1590. 3. Paid for the balance of the purchase in time to receive a discount of 2% of the purchase price. 4. Sold goods costing $24900 for $49820. Cash of $23000 was received, with the balance due on account. 5. Goods sold on credit for $2020 (cost \$1010) were returned. 6. A physical count of the inventory at the end of the current period shows inventory of $30000 to be on hand. Assuming that the business uses a perpetual inventory system and GST is to be added to the figures where appropriate, record the above transactions in its general journal. " Note 1: Show calculations for GST and discounts. Amounts given above are exclusive of GST. - Note 2: Do not round off calculations (take to the nearest cent)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started