Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assume that on 31 December 2019, an Australian firm set up a wholly owned firm in the US when the exchange rate between the

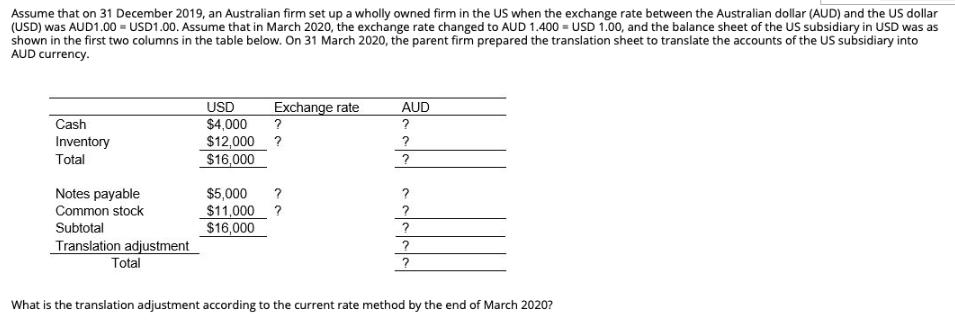

Assume that on 31 December 2019, an Australian firm set up a wholly owned firm in the US when the exchange rate between the Australian dollar (AUD) and the US dollar (USD) was AUD1.00 = USD1.00. Assume that in March 2020, the exchange rate changed to AUD 1.400 = USD 1.00, and the balance sheet of the US subsidiary in USD was as shown in the first two columns in the table below. On 31 March 2020, the parent firm prepared the translation sheet to translate the accounts of the US subsidiary into AUD currency. Cash Inventory Total Notes payable Common stock Subtotal Translation adjustment Total USD $4,000 $12,000 $16,000 Exchange rate ? ? ? $5,000 $11,000 ? $16,000 AUD ? ? ? 2 ? ? ? ? What is the translation adjustment according to the current rate method by the end of March 2020?

Step by Step Solution

★★★★★

3.43 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Calculate the translation adjustment according to the current rate method Given Exchange rate on Mar...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started