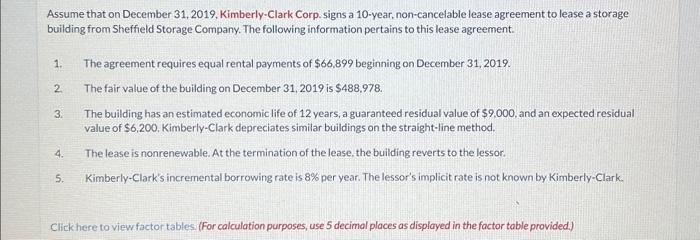

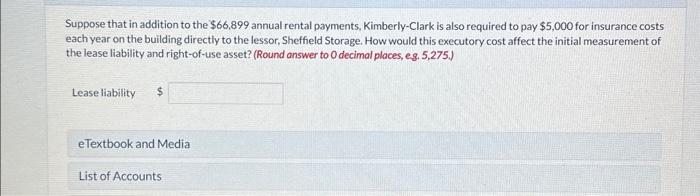

Assume that on December 31, 2019. Kimberly-Clark Corp. signs a 10-year, non-cancelable lease agreement to lease a storage building from Sheffield Storage Company. The following information pertains to this lease agreement. 1. The agreement requires equal rental payments of $66,899 beginning on December 31,2019. 2. The fair value of the building on December 31,2019 is $488,978. 3. The building has an estimated economic life of 12 years, a guaranteed residual value of $9.000, and an expected residual value of $6,200. Kimberly-Clark depreciates similar buildings on the straight-line method. 4. The lease is nonrenewable. At the termination of the lease, the building reverts to the lessor. 5. Kimberly-Clark's incremental borrowing rate is 8% per year. The lessor's implicit rate is not known by Kimberly-Clark. Click here to view factor tables: (For calculation purposes, use 5 decimal places as displayed in the factor table provided.) Suppose that in addition to the $66,899 annual rental payments, Kimberly-Clark is also required to pay $5,000 for insurance costs each year on the building directly to the lessor, Sheffield Storage. How would this executory cost affect the initial measurement of the lease liability and right-of-use asset? (Round answer to O decimal ploces, eg. 5,275.) Lease liability List of Accounts (d) The parts of this question must be completed in order. This part will be available when you complete the part above. Assume that on December 31,2019, Kimberly-Clark Corp. signs a 10-year, non-cancelable lease agreement to lease a storage building from Sheffield Storage Company. The following information pertains to this lease agreement. 1. The agreement requires equal rental payments of $66,899 beginning on December 31,2019. 2. The fair value of the building on December 31,2019 is $488,978. 3. The building has an estimated economic life of 12 years, a guaranteed residual value of $9,000, and an {x pected residual value of $6,200. Kimberly-Clark depreciates similar buildings on the straight-line method. 4. The lease is nonrenewable. At the termination of the lease, the building reverts to the lessor. 5. Kimberly-Clark's incremental borrowing rate is 8% per year. The lessor's implicit rate is not known by Kimberly-Clark. Suppose that in addition to the $66,899 annual rental payments, Kimberly-Clark is also required to pay $5,000 for insurance costs each year on the building directly to the lessor, Sheffield Storage. How would this executory cost affect the initial measurement of the lease liability and right-of-use asset? (Round answer to O decimal places, eg. 5,275.) Lease liability $ Assume that on December 31, 2019. Kimberly-Clark Corp. signs a 10-year, non-cancelable lease agreement to lease a storage building from Sheffield Storage Company. The following information pertains to this lease agreement. 1. The agreement requires equal rental payments of $66,899 beginning on December 31,2019. 2. The fair value of the building on December 31,2019 is $488,978. 3. The building has an estimated economic life of 12 years, a guaranteed residual value of $9.000, and an expected residual value of $6,200. Kimberly-Clark depreciates similar buildings on the straight-line method. 4. The lease is nonrenewable. At the termination of the lease, the building reverts to the lessor. 5. Kimberly-Clark's incremental borrowing rate is 8% per year. The lessor's implicit rate is not known by Kimberly-Clark. Click here to view factor tables: (For calculation purposes, use 5 decimal places as displayed in the factor table provided.) Suppose that in addition to the $66,899 annual rental payments, Kimberly-Clark is also required to pay $5,000 for insurance costs each year on the building directly to the lessor, Sheffield Storage. How would this executory cost affect the initial measurement of the lease liability and right-of-use asset? (Round answer to O decimal ploces, eg. 5,275.) Lease liability List of Accounts (d) The parts of this question must be completed in order. This part will be available when you complete the part above. Assume that on December 31,2019, Kimberly-Clark Corp. signs a 10-year, non-cancelable lease agreement to lease a storage building from Sheffield Storage Company. The following information pertains to this lease agreement. 1. The agreement requires equal rental payments of $66,899 beginning on December 31,2019. 2. The fair value of the building on December 31,2019 is $488,978. 3. The building has an estimated economic life of 12 years, a guaranteed residual value of $9,000, and an {x pected residual value of $6,200. Kimberly-Clark depreciates similar buildings on the straight-line method. 4. The lease is nonrenewable. At the termination of the lease, the building reverts to the lessor. 5. Kimberly-Clark's incremental borrowing rate is 8% per year. The lessor's implicit rate is not known by Kimberly-Clark. Suppose that in addition to the $66,899 annual rental payments, Kimberly-Clark is also required to pay $5,000 for insurance costs each year on the building directly to the lessor, Sheffield Storage. How would this executory cost affect the initial measurement of the lease liability and right-of-use asset? (Round answer to O decimal places, eg. 5,275.) Lease liability $