Question

Assume that on January 1, year 1, ABC Inc. issued 7,500 stock options with an estimated value of $6 per option. Each option entitles the

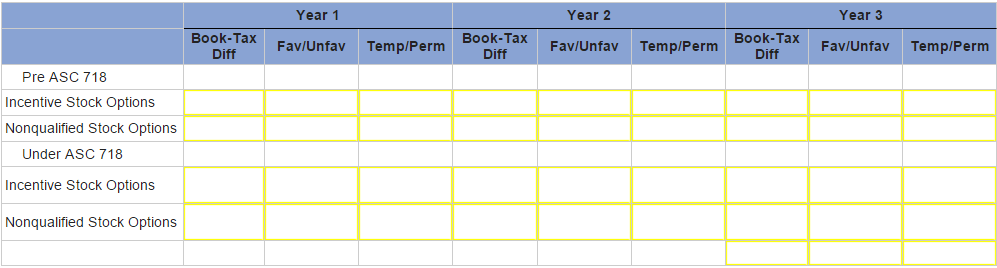

Assume that on January 1, year 1, ABC Inc. issued 7,500 stock options with an estimated value of $6 per option. Each option entitles the owner to purchase one share of ABC stock for $33 a share (the per share price of ABC stock on January 1, year 1, when the options were granted). The options vest 40 percent at the end of the day on December 31, year 1, and 60 percent at the end of the day on December 31, year 2. All 7,500 stock options were exercised in year 3 when the ABC stock was valued at $36 per share. Identify ABCs year 1, 2, and 3 tax deductions and book-tax differences (indicate whether permanent and/or temporary) associated with the stock options under the following alternative scenarios: (Input all amounts as positive values.) (Leave no answer blank. Enter zero if applicable.)

a. The stock options are incentive stock options and ASC 718 (the codification of FAS 123R) does not apply to the options.

b. The stock options are nonqualified stock options and ASC 718 does not apply to the options.

c. The stock options are incentive stock options and ASC 718 applies to the options.

d. The stock options are nonqualified stock options and ASC 718 applies to the options. Complete the following table.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started