Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assume that one of your relatives, on your behalf, invested $100,000 in a trust holding S&P 500 stocks at the beginning of 1926. Using the

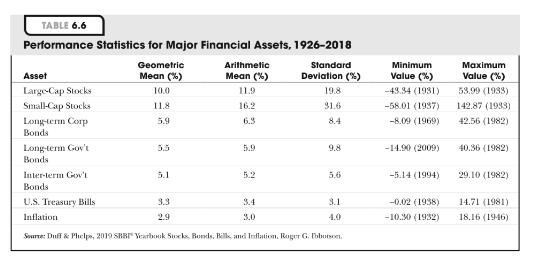

Assume that one of your relatives, on your behalf, invested $100,000 in a trust holding S&P 500 stocks at the beginning of 1926. Using the data in Table 6.6, determine the value of this trust at the end of 2018.

TABLE 6.6 Performance Statistics for Major Financial Assets, 1926-2018 Arithmetic Mean (%) Geometric Standard Minimum Maximum Asset Mean (%) Deviation (%) Value (%) Value (%) Large-Cap Stocks Small-Cap Stocks 10.0 11.9 19.8 -43.34 (1931) 53.99 (1933) 11.8 16.2 31.6 -58.01 (1937) 142.87 (1933) 6.3 -8.09 (1969) 42.56 (1982) Long-tern Corp Bonds 5.9 8.4 Long term Gov't Bonds 5.5 5.9 9.8 -14.90 (2009) 40.36 (1982) Inter-term Gew't 5.1 5.2 5.6 -5.14 (1994) 29.10 (1982) Bonds U.S. Treasury Bills 3.3 3.4 3.1 -0.02 (1938) 14.71 (1981) Inflation 2.9 3.0 4.0 -10.30 (1932) 18.16 (1946) Sourre: Duff & Phelpe, 2019 SBRI Vearbok Sucks Bunds, Belk and Inflation, Roger G. bbotson.

Step by Step Solution

★★★★★

3.37 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

If relative have invested 10...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started