Answered step by step

Verified Expert Solution

Question

1 Approved Answer

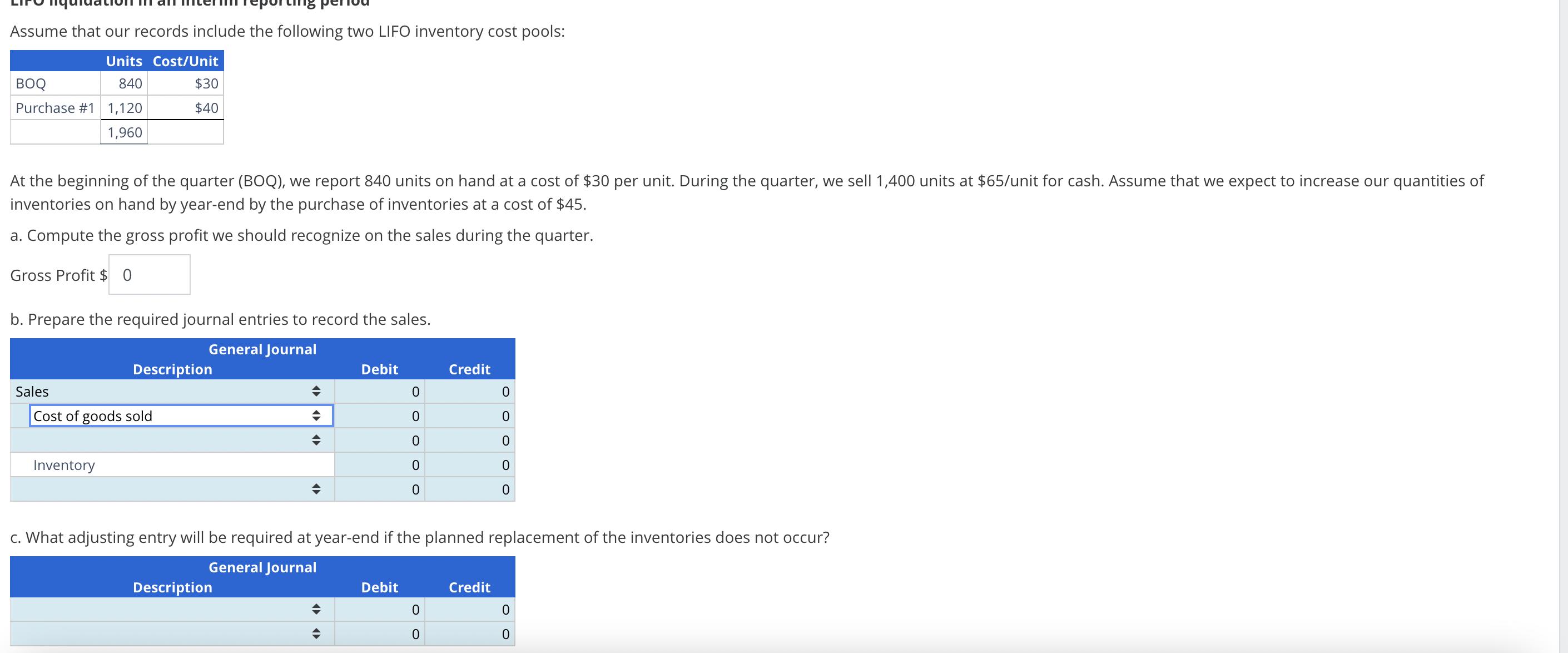

Assume that our records include the following two LIFO inventory cost pools: Units Cost/Unit BOQ 840 Purchase #1 1,120 1,960 At the beginning of

Assume that our records include the following two LIFO inventory cost pools: Units Cost/Unit BOQ 840 Purchase #1 1,120 1,960 At the beginning of the quarter (BOQ), we report 840 units on hand at a cost of $30 per unit. During the quarter, we sell 1,400 units at $65/unit for cash. Assume that we expect to increase our quantities of inventories on hand by year-end by the purchase of inventories at a cost of $45. a. Compute the gross profit we should recognize on the sales during the quarter. Gross Profit $ 0 b. Prepare the required journal entries to record the sales. General Journal Sales $30 $40 Cost of goods sold Inventory Description Description Debit 0 0 0 0 0 Debit c. What adjusting entry will be required at year-end if the planned replacement of the inventories does not occur? General Journal Credit 0 0 0 0 0 0 0 Credit 0 0

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Compute the gross profit we should recognize on the sales during the quarter Units sold during the quarter 1400 units Cost per unit of the most rece...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started