Question

Assume that (perpetual) debt is issued (and shares are repurchased with the proceeds) at the end of 1993 in the value of either 10%, 20%

Assume that (perpetual) debt is issued (and shares are repurchased with the proceeds) at the end of 1993 in the value of either 10%, 20% or 30% of the pre-repurchase market value of UST (i.e., of the market value based on the table ). Assume further that, for 1994, EBIT remains $576 million.

Compute the table for UST for 1994 under the three different repurchase scenarios. En route, you may need to answer the following question:

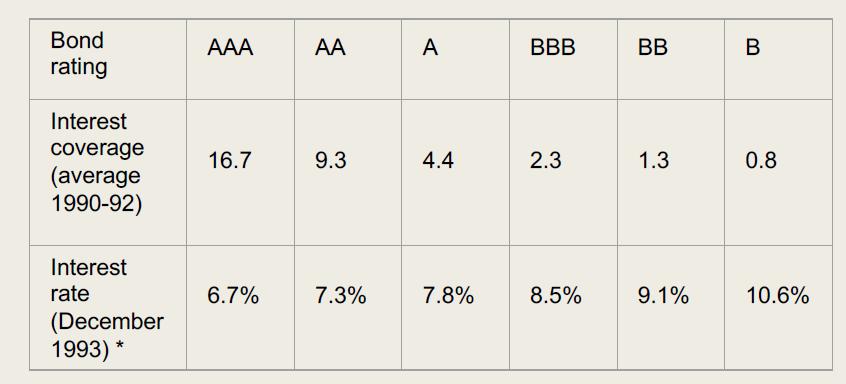

What do you expect UST's bond rating and interest rate to be at each of the debt levels? Be as precise as possible, but conservative in your estimation and explain briefly how you came up with these (rough) estimates.

Bond rating Interest coverage (average 1990-92) Interest rate (December 1993) * AAA 16.7 6.7% AA 9.3 7.3% A 4.4 7.8% BBB 2.3 8.5% BB 1.3 9.1% B 0.8 10.6%

Step by Step Solution

3.55 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

To compute the table for UST for 1994 under the three different repurchase scenarios you need to con...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started