Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assume that prior to January 1, 2022, a Reporting Company owned a 15 percent interest in a Legal Entity. The Reporting Company acquired its

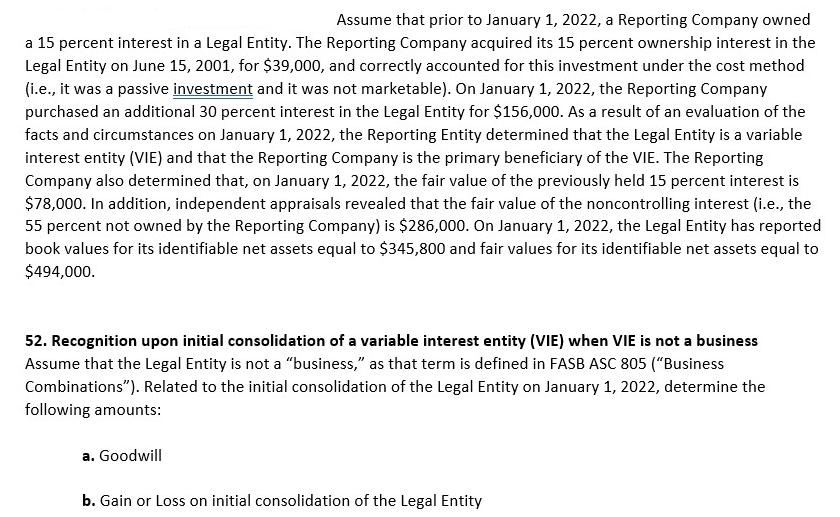

Assume that prior to January 1, 2022, a Reporting Company owned a 15 percent interest in a Legal Entity. The Reporting Company acquired its 15 percent ownership interest in the Legal Entity on June 15, 2001, for $39,000, and correctly accounted for this investment under the cost method (i.e., it was a passive investment and it was not marketable). On January 1, 2022, the Reporting Company purchased an additional 30 percent interest in the Legal Entity for $156,000. As a result of an evaluation of the facts and circumstances on January 1, 2022, the Reporting Entity determined that the Legal Entity is a variable interest entity (VIE) and that the Reporting Company is the primary beneficiary of the VIE. The Reporting Company also determined that, on January 1, 2022, the fair value of the previously held 15 percent interest is $78,000. In addition, independent appraisals revealed that the fair value of the noncontrolling interest (i.e., the 55 percent not owned by the Reporting Company) is $286,000. On January 1, 2022, the Legal Entity has reported book values for its identifiable net assets equal to $345,800 and fair values for its identifiable net assets equal to $494,000. 52. Recognition upon initial consolidation of a variable interest entity (VIE) when VIE is not a business Assume that the Legal Entity is not a "business," as that term is defined in FASB ASC 805 ("Business Combinations"). Related to the initial consolidation of the Legal Entity on January 1, 2022, determine the following amounts: a. Goodwill b. Gain or Loss on initial consolidation of the Legal Entity

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Goodwill To calculate the goodwill upon the initial consolidation of the Legal Entity on January 1 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started