Assume that Sheridan Company decides to estimate its uncollectible accounts using the allowance method and estimates its bad debt expense at 2.85% of credit

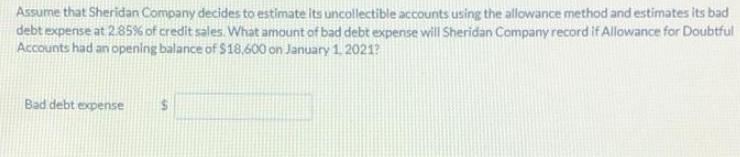

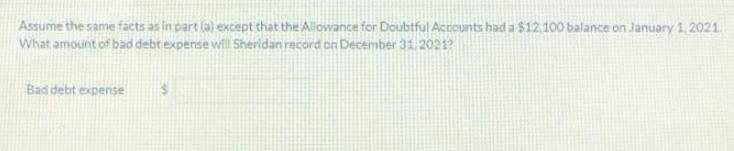

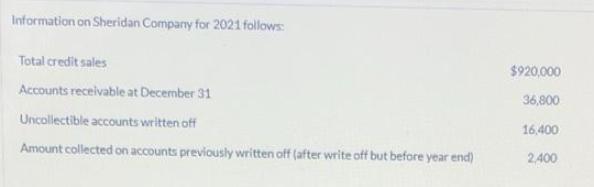

Assume that Sheridan Company decides to estimate its uncollectible accounts using the allowance method and estimates its bad debt expense at 2.85% of credit sales. What amount of bad debt expense will Sheridan Company record if Allowance for Doubtful Accounts had an opening balance of $18,600 on January 1 2021? Bad debt expense Assume the same facts as in part (al except that the Alowance for Doubtful Accounts had a $12,100 balance on January 1,2021 What amount of bad debt expense will Sheridan record on December 31. 20212 Bad debt expense Information on Sheridan Company for 2021 follows: Total credit sales $920,000 Accounts receivable at December 31 36,800 Uncollectible accounts written off 16,400 Amount collected on accounts previously written off (after write off but before year end) 2,400

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Shonde Co Gle Unclochbe sle as eshnahd 6d deLa ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started