Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assume that Sigma Group has a market equity capitalisation of $10.8 billion and its enterprise value is $14.4 billion. The company's equity holders require

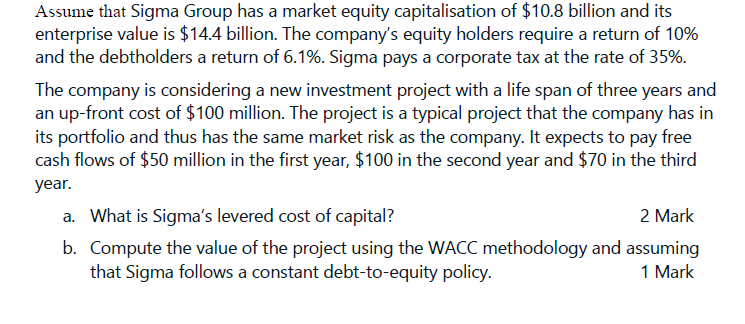

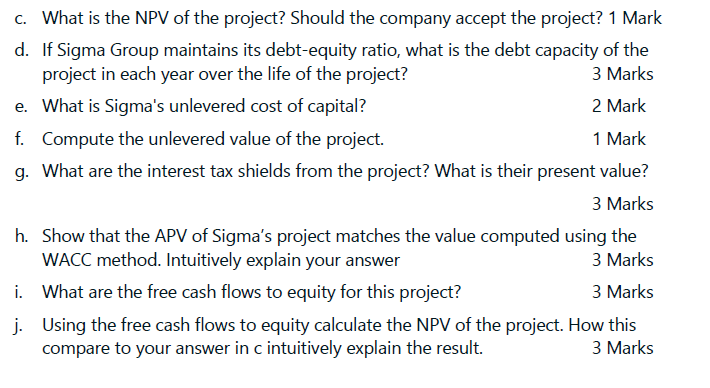

Assume that Sigma Group has a market equity capitalisation of $10.8 billion and its enterprise value is $14.4 billion. The company's equity holders require a return of 10% and the debtholders a return of 6.1%. Sigma pays a corporate tax at the rate of 35%. The company is considering a new investment project with a life span of three years and an up-front cost of $100 million. The project is a typical project that the company has in its portfolio and thus has the same market risk as the company. It expects to pay free cash flows of $50 million in the first year, $100 in the second year and $70 in the third year. a. What is Sigma's levered cost of capital? 2 Mark b. Compute the value of the project using the WACC methodology and assuming that Sigma follows a constant debt-to-equity policy. 1 Mark c. What is the NPV of the project? Should the company accept the project? 1 Mark d. If Sigma Group maintains its debt-equity ratio, what is the debt capacity of the project in each year over the life of the project? e. What is Sigma's unlevered cost of capital? f. Compute the unlevered value of the project. 3 Marks 2 Mark 1 Mark g. What are the interest tax shields from the project? What is their present value? 3 Marks h. Show that the APV of Sigma's project matches the value computed using the WACC method. Intuitively explain your answer 3 Marks i. What are the free cash flows to equity for this project? 3 Marks j. Using the free cash flows to equity calculate the NPV of the project. How this compare to your answer in c intuitively explain the result. 3 Marks

Step by Step Solution

★★★★★

3.49 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

Answer Sigma Group Investment Project Analysis a Levered Cost of Capital LCC We cant directly calculate LCC with the given information However we have the data to estimate it using the Weighted Averag...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started