Answered step by step

Verified Expert Solution

Question

1 Approved Answer

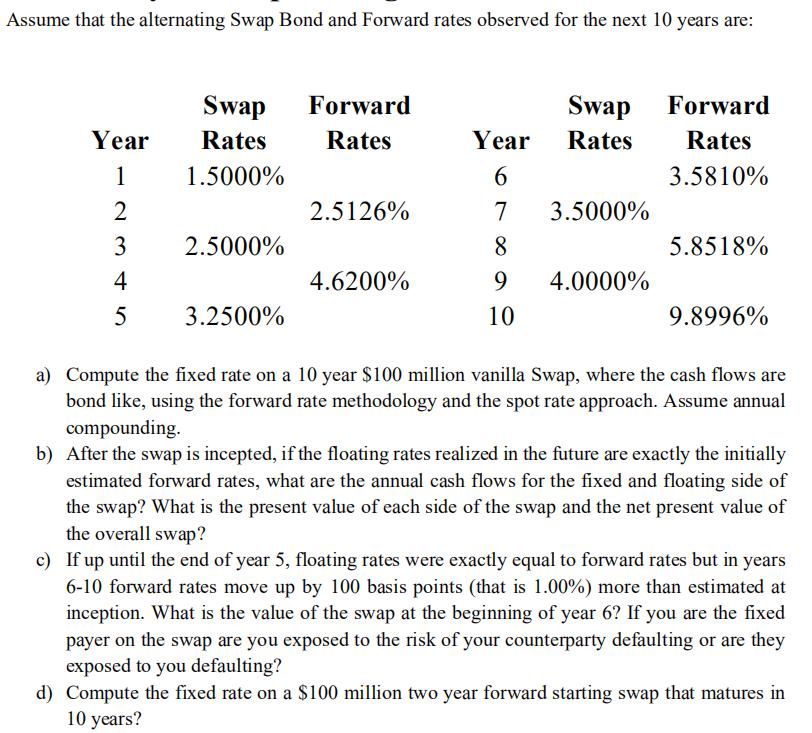

Assume that the alternating Swap Bond and Forward rates observed for the next 10 years are: Year 1 23 2 3 45 4 Swap

Assume that the alternating Swap Bond and Forward rates observed for the next 10 years are: Year 1 23 2 3 45 4 Swap Rates 1.5000% 2.5000% 5 3.2500% Forward Rates 2.5126% 4.6200% Swap Rates Year 6 7 3.5000% 8 9 10 4.0000% Forward Rates 3.5810% 5.8518% 9.8996% a) Compute the fixed rate on a 10 year $100 million vanilla Swap, where the cash flows are bond like, using the forward rate methodology and the spot rate approach. Assume annual compounding. b) After the swap is incepted, if the floating rates realized in the future are exactly the initially estimated forward rates, what are the annual cash flows for the fixed and floating side of the swap? What is the present value of each side of the swap and the net present value of the overall swap? c) If up until the end of year 5, floating rates were exactly equal to forward rates but in years 6-10 forward rates move up by 100 basis points (that is 1.00%) more than estimated at inception. What is the value of the swap at the beginning of year 6? If you are the fixed payer on the swap are you exposed to the risk of your counterparty defaulting or are they exposed to you defaulting? d) Compute the fixed rate on a $100 million two year forward starting swap that matures in 10 years?

Step by Step Solution

★★★★★

3.34 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION a To compute the fixed rate on a 10year 100 million vanilla Swap using the forward rate methodology and the spot rate approach we can use the provided forward rates Forward Rate Methodology W...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started