Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assume that the Board of Directors has chosen to assign $523,000 of the cooperative's Net Income to the Unallocated Reserve (rather than the actual

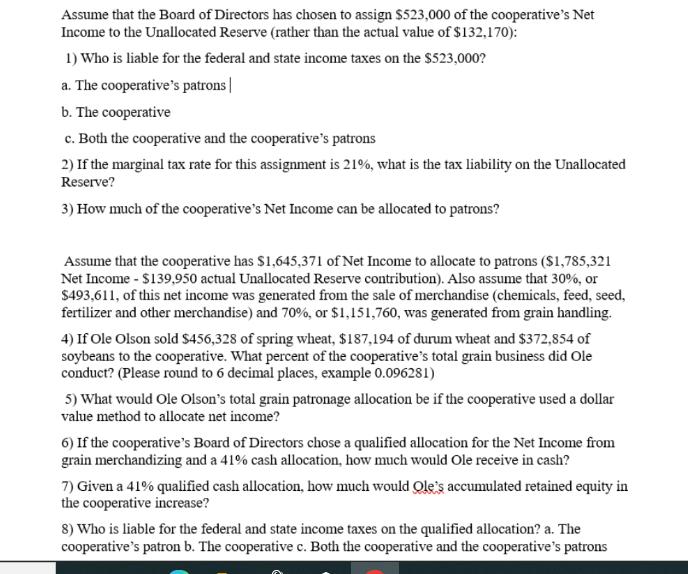

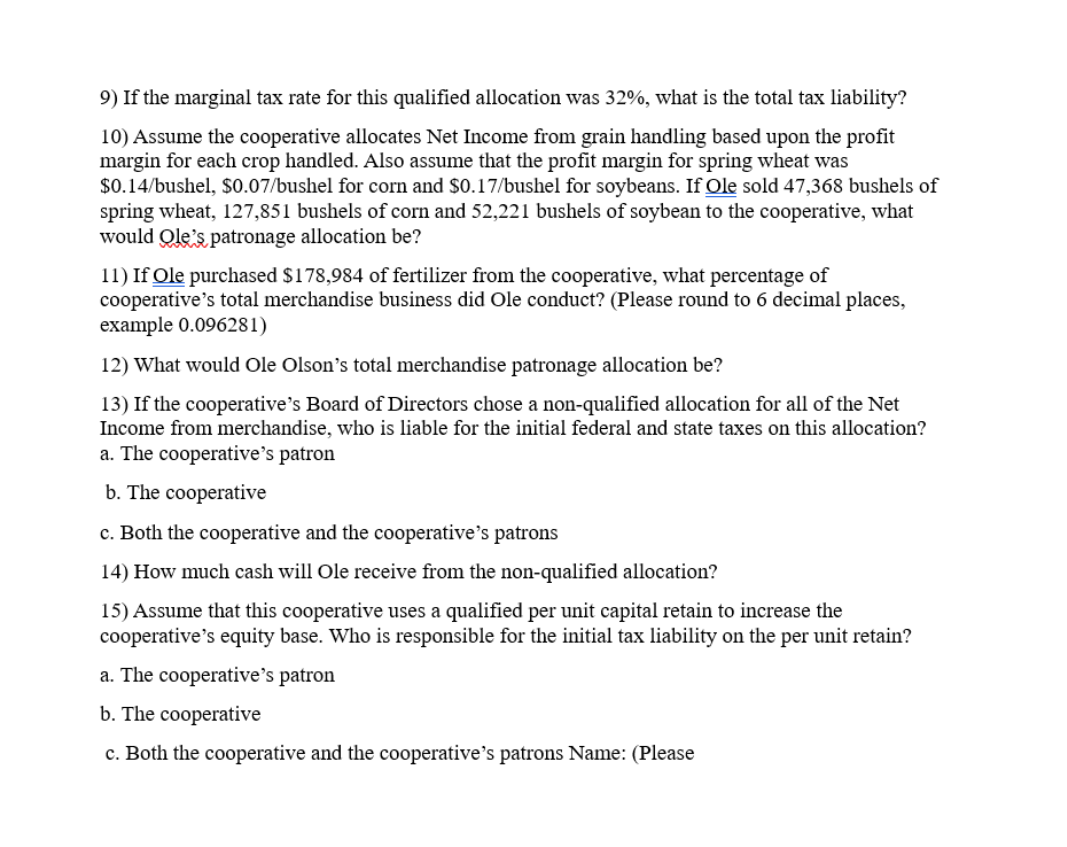

Assume that the Board of Directors has chosen to assign $523,000 of the cooperative's Net Income to the Unallocated Reserve (rather than the actual value of $132,170): 1) Who is liable for the federal and state income taxes on the $523,000? a. The cooperative's patrons | b. The cooperative c. Both the cooperative and the cooperative's patrons 2) If the marginal tax rate for this assignment is 21%, what is the tax liability on the Unallocated Reserve? 3) How much of the cooperative's Net Income can be allocated to patrons? Assume that the cooperative has $1,645,371 of Net Income to allocate to patrons ($1,785,321 Net Income $139,950 actual Unallocated Reserve contribution). Also assume that 30%, or $493,611, of this net income was generated from the sale of merchandise (chemicals, feed, seed, fertilizer and other merchandise) and 70%, or $1,151,760, was generated from grain handling. 4) If Ole Olson sold $456,328 of spring wheat, $187,194 of durum wheat and $372,854 of soybeans to the cooperative. What percent of the cooperative's total grain business did Ole conduct? (Please round to 6 decimal places, example 0.096281) 5) What would Ole Olson's total grain patronage allocation be if the cooperative used a dollar value method to allocate net income? 6) If the cooperative's Board of Directors chose a qualified allocation for the Net Income from grain merchandizing and a 41% cash allocation, how much would Ole receive in cash? 7) Given a 41% qualified cash allocation, how much would Ole's accumulated retained equity in the cooperative increase? 8) Who is liable for the federal and state income taxes on the qualified allocation? a. The cooperative's patron b. The cooperative c. Both the cooperative and the cooperative's patrons 9) If the marginal tax rate for this qualified allocation was 32%, what is the total tax liability? 10) Assume the cooperative allocates Net Income from grain handling based upon the profit margin for each crop handled. Also assume that the profit margin for spring wheat was $0.14/bushel, $0.07/bushel for corn and $0.17/bushel for soybeans. If Ole sold 47,368 bushels of spring wheat, 127,851 bushels of corn and 52,221 bushels of soybean to the cooperative, what would Ole's patronage allocation be? 11) If Ole purchased $178,984 of fertilizer from the cooperative, what percentage of cooperative's total merchandise business did Ole conduct? (Please round to 6 decimal places, example 0.096281) 12) What would Ole Olson's total merchandise patronage allocation be? 13) If the cooperative's Board of Directors chose a non-qualified allocation for all of the Net Income from merchandise, who is liable for the initial federal and state taxes on this allocation? a. The cooperative's patron b. The cooperative c. Both the cooperative and the cooperative's patrons 14) How much cash will Ole receive from the non-qualified allocation? 15) Assume that this cooperative uses a qualified per unit capital retain to increase the cooperative's equity base. Who is responsible for the initial tax liability on the per unit retain? a. The cooperative's patron b. The cooperative c. Both the cooperative and the cooperative's patrons Name: (Please

Step by Step Solution

There are 3 Steps involved in it

Step: 1

ANSWER The cooperatives patrons are liable for the federal and state income taxes on the 523000 assi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started