Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assume that the CAPM holds, but that the market portfolio is unobservable, so that the return on the market portfolio is unknown (therefore, so are

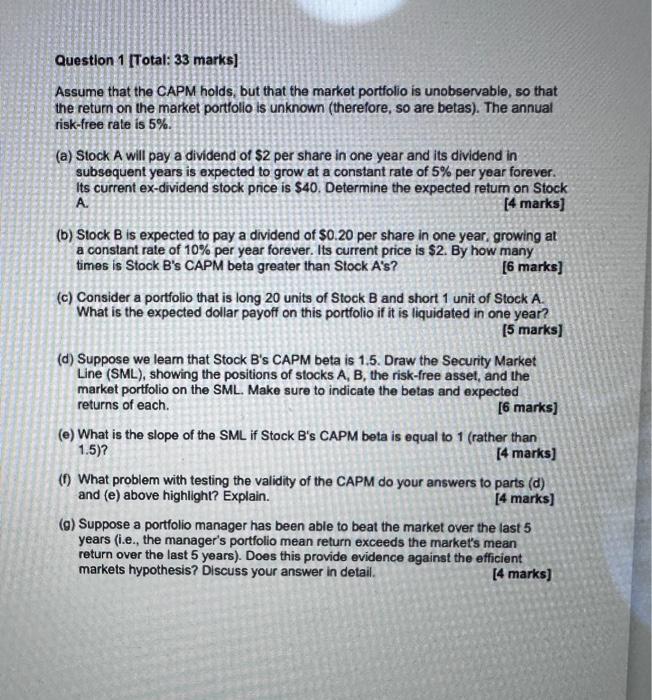

Assume that the CAPM holds, but that the market portfolio is unobservable, so that the return on the market portfolio is unknown (therefore, so are betas). The annual risk-free rate is 5%.

(a) Stock A will pay a dividend of $2 per share in one year and its dividend in subsequent years is expected to grow at a constant rate of 5% per year forever. Its current ex-dividend stock price is $40. Determine the expected return on Stock

(b) Stock B is expected to pay a dividend of $0.20 per share in one year, growing at a constant rate of 10% per year forever. Its current price is $2. By how many times is Stock B's CAPM beta greater than Stock A's?(c) Consider a portfolio that is long 20 units of Stock B and short 1 unit of Stock A.. What is the expected dollar payoff on this portfolio if it is liquidated in one year?

(d) Suppose we learn that Stock B's CAPM beta is 1.5. Draw the Security Market Line (SML), showing the positions of stocks A, B, the risk-free asset, and the market portfolio on the SML. Make sure to indicate the betas and expected returns of each.

(e) What is the slope of the SML if Stock B's CAPM beta is equal to 1 (rather than 1.5)?

(f) What problem with testing the validity of the CAPM do your answers to parts (d) and (e) above highlight? Explain.

(g) Suppose a portfolio manager has been able to beat the market over the last 5 years (i.e., the manager's portfolio mean return exceeds the market's mean return over the last 5 years). Does this provide evidence against the efficient markets hypothesis? Discuss your answer in detail.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started