Answered step by step

Verified Expert Solution

Question

1 Approved Answer

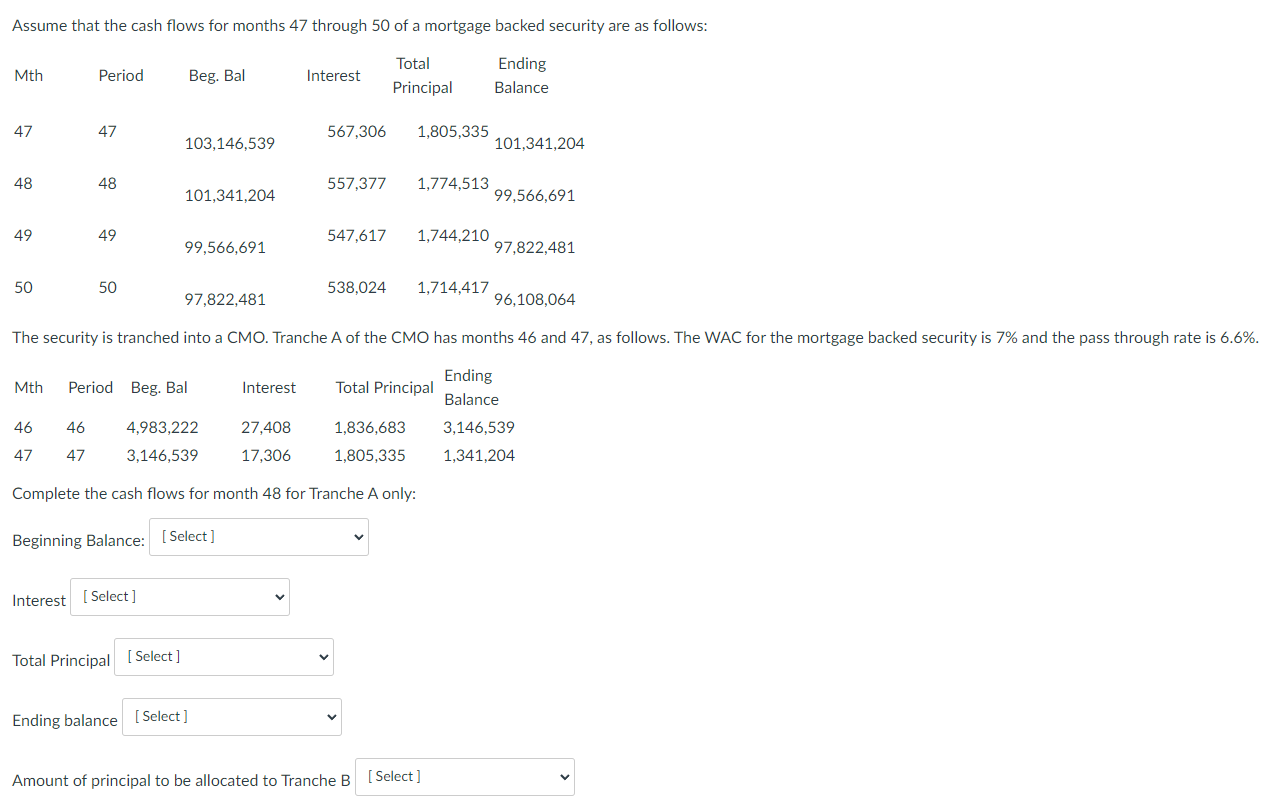

Assume that the cash flows for months 47 through 50 of a mortgage backed security are as follows: Ending Total Principal Balance Mth 47

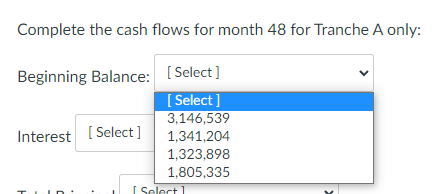

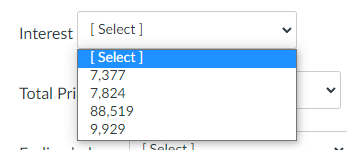

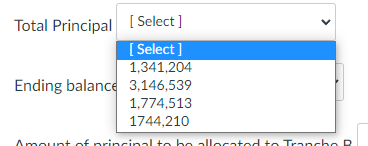

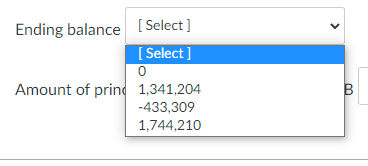

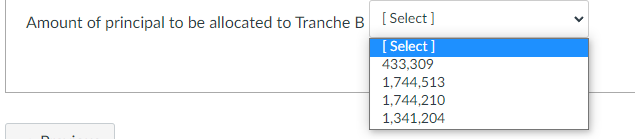

Assume that the cash flows for months 47 through 50 of a mortgage backed security are as follows: Ending Total Principal Balance Mth 47 48 49 50 Period 47 48 49 50 Beg. Bal Interest [Select] 103,146,539 Total Principal [Select] 101,341,204 99,566,691 Interest 567,306 1,805,335 Ending balance [Select] 557,377 1,774,513 547,617 1,744,210 538,024 Mth Period Beg. Bal 46 46 47 47 4,983,222 3,146,539 27,408 17,306 Complete the cash flows for month 48 for Tranche A only: Beginning Balance: [Select] 1,714,417 97,822,481 The security is tranched into a CMO. Tranche A of the CMO has months 46 and 47, as follows. The WAC for the mortgage backed security is 7% and the pass through rate is 6.6%. Ending Balance 3,146,539 1,836,683 1,805,335 1,341,204 Interest Total Principal 101,341,204 Amount of principal to be allocated to Tranche B [Select] 99,566,691 97,822,481 96,108,064 Complete the cash flows for month 48 for Tranche A only: Beginning Balance: [Select] [Select] 3,146,539 1,341,204 1,323,898 1,805,335 Interest [Select] [Select] Interest [Select] [Select] 7,377 Total Pri 7,824 88,519 9,929 L [Select] Total Principal [Select] [Select] 1,341,204 Ending balance 3,146,539 1,774,513 1744,210 Amount of principal to ho allocated to Trancho R Ending balance [Select] [Select] 0 Amount of prin 1,341,204 -433,309 1,744,210 B Amount of principal to be allocated to Tranche B [Select] [Select] 433,309 1,744,513 1,744,210 1,341,204

Step by Step Solution

★★★★★

3.50 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

We need to calculate the interest and the amount of principal to be allocated to Tranche B for month ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started