Answered step by step

Verified Expert Solution

Question

1 Approved Answer

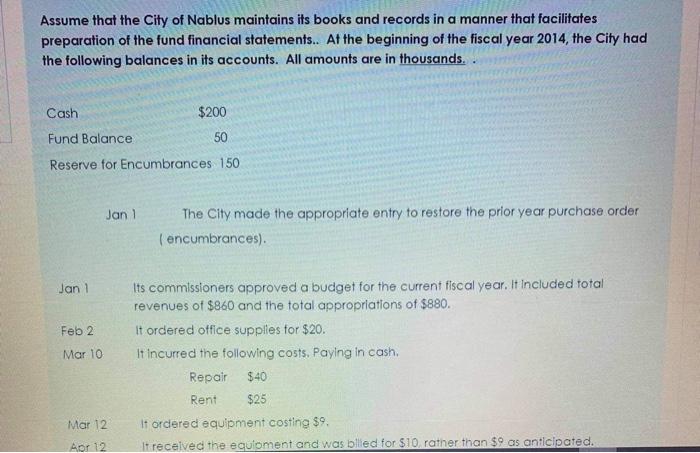

Assume that the City of Nablus maintains its books and records in a manner that facilitates preparation of the fund financial statements. At the

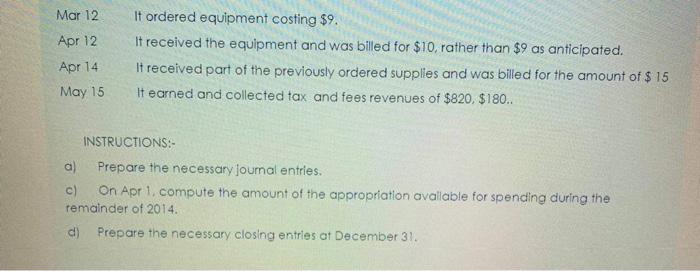

Assume that the City of Nablus maintains its books and records in a manner that facilitates preparation of the fund financial statements. At the beginning of the fiscal year 2014, the City had the following balances in its accounts. All amounts are in thousands. Cash $200 Fund Balance 50 Reserve for Encumbrances 150 Jan 1 The City made the appropriate entry to restore the prior year purchase order ( encumbrances). Its commissioners approved a budget for the current fiscal year. It Included total revenues of $860 and the total approprlations of $880. Jan 1 Feb 2 It ordered office supplles for $20. Mar 10 It Incurred the following costs. Paying in cash. Repair $40 Rent $25 Mar 12 It ordered equipment costing $9. Apr 12 It recelved the equioment and was bled for $10. rather than $9 as anticipated. Mar 12 It ordered equipment costing $9. Apr 12 It received the equipment and was billed for $10, rather than $9 as anticipated. Apr 14 It received part of the previously ordered supples and was billed for the amount of $ 15 May 15 It earned and collected tax and fees revenues of $820, $180.. INSTRUCTIONS:- a) Prepare the necessary Journal entrles. c) On Apr 1, compute the amount of the appropriation avallable for spending during the remalnder of 2014. d) Prepare the necessary closing entries at December 31.

Step by Step Solution

★★★★★

3.43 Rating (169 Votes )

There are 3 Steps involved in it

Step: 1

Here is my answer to the given question Jan 1 Estimated revenues8...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started