Answered step by step

Verified Expert Solution

Question

1 Approved Answer

assume that the Coca-Cola is expected annual growth in earnings is 6% and investors required rate of return is 9%, calculate the following: Dividend payout

assume that the Coca-Cola is expected annual growth in earnings is 6% and investors required rate of return is 9%, calculate the following: Dividend payout ratio, dividend rate, it's stock price, and price earnings ratio.

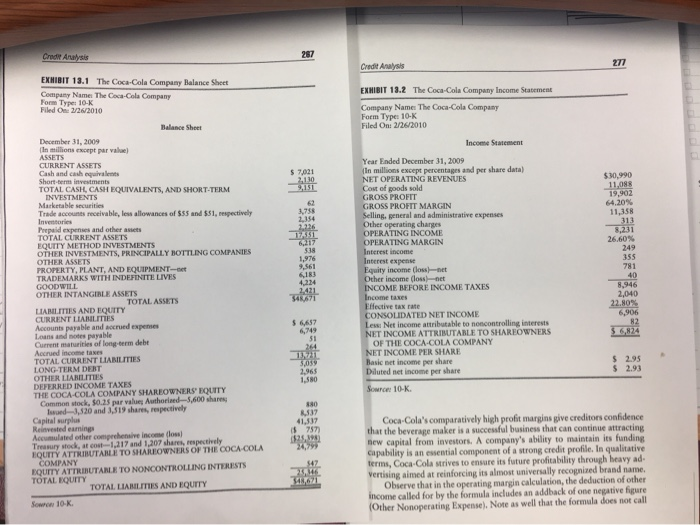

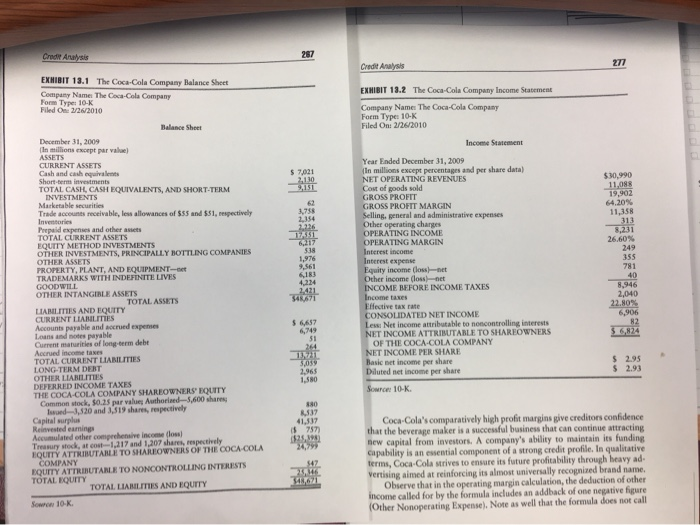

Cradle Analysis Credit Analysis EXHIBIT 13.1 The Coca-Cola Company Balance Sheet Company Name The Coca-Cola Company Form Type 10-K Filed On 1/26/2010 Balance Sheet December 31, 2009 In millions except par value EXHIBIT 13.2 The Coca-Cola Company Income Statement Company Name: The Coca-Cola Company Form Type: 10-K Filed On 2/262010 Income Statement CURRENT ASSETS Cash and cash equivalent TOTAL CASH, CASH EQUIVALENTS, AND SHORT-TERM INVESTMENTS Marketable securities Trade accounts receivable, less allowances of $55 and $S1, respectively Year Ended December 31, 2009 (in millions except percentages and per share data) NET OPERATING REVENUES Cost of goods sold GROSS PROFIT GROSS PROFIT MARGIN Selling, general and administrative expenses Other operating charges OPERATING INCOME OPERATING MARGIN Interest income Interest expense Equity income clos et Other income (lossnet INCOME BEFORE INCOME TAXES $10.990 11,088 199,902 64,20% 11.358 313 2.354 173351 Prepaid expenses and other assets TOTAL CURRENT ASSETS EQUITY METHOD INVESTMENTS OTHER INVESTMENTS, PRINCIPALLY BOTTLING COMPANIES 26,60% 355 SRTV 2,040 22.80% $ 6,657 Effective tax rate CONSOLIDATED NET INCOME LevNet Income attributable to noncontrolling interests NET INCOME ATTRIBUTABLE TO SHARFOWNERS OF THE COCA-COLA COMPANY NET INCOME PER SHARE Basic net income per share Diluted net income per share 264 $ 2.95 1.580 PROPERTY, PLANT, AND EQUIPMENT TRADEMARKS WITH INDEFINITE LIVES GOODWILL OTHER INTANGIBLE ASSETS TOTAL ASSETS LIABILITIES AND EQUITY CURRENT LIABILITIES Accounts payable and cred expenses Loans and modes payable Current maturities of long-term debt Accrued income taxes TOTAL CURRENT LIABILITIES LONG-TERM DERT OTHER LIABILITIES DEFERRED INCOME TAXES THE COCA-COLA COMPANY SHAREOWNERS OUTY Common stock, 10.25 par values Authorized5,600 shares uued 1,520 and 3,319 shares, respectively Capital surplus Reinvested earnings Accumulated other comprehensive Income (loss Treasury stock, at cost 1,217 and 1,207 shares, respectively EQUITY ATTRIBUTARL TO SHARE OWNERS OF THE COCA-COLA COMPANY EQUITY ATTRIBUTARLE TO NONCONTROLLING INTERESTS TOTAL EQUITY TOTAL LIABILITIES AND EQUITY Sow 10K Source: 10-K 8,537 41.517 757) 125,198 24799 Coca-Cola's comparatively high profit margins give creditors confidence that the beverage maker is a successful business that can continue attracting new capital from investors. A company's ability to maintain its funding capability is an essential component of a strong credit profile. In qualitative terms, Coca-Cola strives to ensure its future profitability through heavy ad. vertising aimed at reinforcing its almost universally recognized brand name. Observe that in the operating margin calculation, the deduction of other income called for by the formula includes an addback of one negative figure (Other Nonoperating Expense). Note as well that the formula does not call XE 38,621 Cradle Analysis Credit Analysis EXHIBIT 13.1 The Coca-Cola Company Balance Sheet Company Name The Coca-Cola Company Form Type 10-K Filed On 1/26/2010 Balance Sheet December 31, 2009 In millions except par value EXHIBIT 13.2 The Coca-Cola Company Income Statement Company Name: The Coca-Cola Company Form Type: 10-K Filed On 2/262010 Income Statement CURRENT ASSETS Cash and cash equivalent TOTAL CASH, CASH EQUIVALENTS, AND SHORT-TERM INVESTMENTS Marketable securities Trade accounts receivable, less allowances of $55 and $S1, respectively Year Ended December 31, 2009 (in millions except percentages and per share data) NET OPERATING REVENUES Cost of goods sold GROSS PROFIT GROSS PROFIT MARGIN Selling, general and administrative expenses Other operating charges OPERATING INCOME OPERATING MARGIN Interest income Interest expense Equity income clos et Other income (lossnet INCOME BEFORE INCOME TAXES $10.990 11,088 199,902 64,20% 11.358 313 2.354 173351 Prepaid expenses and other assets TOTAL CURRENT ASSETS EQUITY METHOD INVESTMENTS OTHER INVESTMENTS, PRINCIPALLY BOTTLING COMPANIES 26,60% 355 SRTV 2,040 22.80% $ 6,657 Effective tax rate CONSOLIDATED NET INCOME LevNet Income attributable to noncontrolling interests NET INCOME ATTRIBUTABLE TO SHARFOWNERS OF THE COCA-COLA COMPANY NET INCOME PER SHARE Basic net income per share Diluted net income per share 264 $ 2.95 1.580 PROPERTY, PLANT, AND EQUIPMENT TRADEMARKS WITH INDEFINITE LIVES GOODWILL OTHER INTANGIBLE ASSETS TOTAL ASSETS LIABILITIES AND EQUITY CURRENT LIABILITIES Accounts payable and cred expenses Loans and modes payable Current maturities of long-term debt Accrued income taxes TOTAL CURRENT LIABILITIES LONG-TERM DERT OTHER LIABILITIES DEFERRED INCOME TAXES THE COCA-COLA COMPANY SHAREOWNERS OUTY Common stock, 10.25 par values Authorized5,600 shares uued 1,520 and 3,319 shares, respectively Capital surplus Reinvested earnings Accumulated other comprehensive Income (loss Treasury stock, at cost 1,217 and 1,207 shares, respectively EQUITY ATTRIBUTARL TO SHARE OWNERS OF THE COCA-COLA COMPANY EQUITY ATTRIBUTARLE TO NONCONTROLLING INTERESTS TOTAL EQUITY TOTAL LIABILITIES AND EQUITY Sow 10K Source: 10-K 8,537 41.517 757) 125,198 24799 Coca-Cola's comparatively high profit margins give creditors confidence that the beverage maker is a successful business that can continue attracting new capital from investors. A company's ability to maintain its funding capability is an essential component of a strong credit profile. In qualitative terms, Coca-Cola strives to ensure its future profitability through heavy ad. vertising aimed at reinforcing its almost universally recognized brand name. Observe that in the operating margin calculation, the deduction of other income called for by the formula includes an addback of one negative figure (Other Nonoperating Expense). Note as well that the formula does not call XE 38,621

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started