Answered step by step

Verified Expert Solution

Question

1 Approved Answer

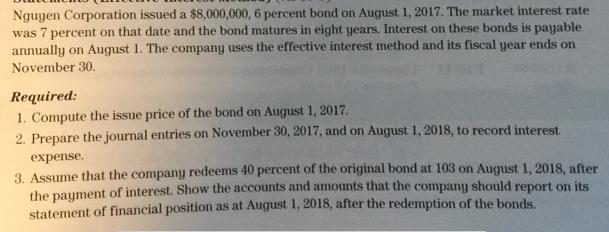

Nguyen Corporation issued a $8,000,000, 6 percent bond on August 1, 2017. The market interest rate was 7 percent on that date and the

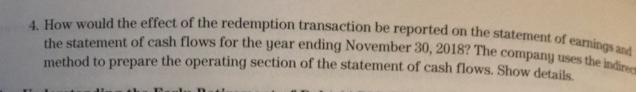

Nguyen Corporation issued a $8,000,000, 6 percent bond on August 1, 2017. The market interest rate was 7 percent on that date and the bond matures in eight years. Interest on these bonds is payable annually on August 1. The company uses the effective interest method and its fiscal year ends on November 30. Required: 1. Compute the issue price of the bond on August 1, 2017. 2. Prepare the journal entries on November 30, 2017, and on August 1, 2018, to record interest expense. 3. Assume that the company redeems 40 percent of the original bond at 103 on August 1, 2018, after the paument of interest. Show the accounts and amounts that the company should report on its statement of financial position as at August 1, 2018, after the redemption of the bonds. 4. How would the effect of the redemption transaction be reported on the statement of earnings and the statement of cash flows for the year ending November 30, 2018? The company uses the indire method to prepare the operating section of the statement of cash flows. Show details

Step by Step Solution

★★★★★

3.39 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Answer Basic details Coupon rate per Period 600 Face value of bond 8000000 Market or Discounting rate per Period 700 Interest paid 80000006 480000 Payment at end of period with Face value8000000480000 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started