Question

Assume that the company you work for (well call it Stripe) is planning on acquiring 100% of the outstanding common stock of Turning Point Brands

Assume that the company you work for (well call it Stripe) is planning on acquiring 100% of the outstanding common stock of Turning Point Brands for cash, at a cost of $1,200,000,000 (thats $1.2 billion). The shares will be purchased from existing stockholders (there are more than 3,000 of them), not from Turning Point.

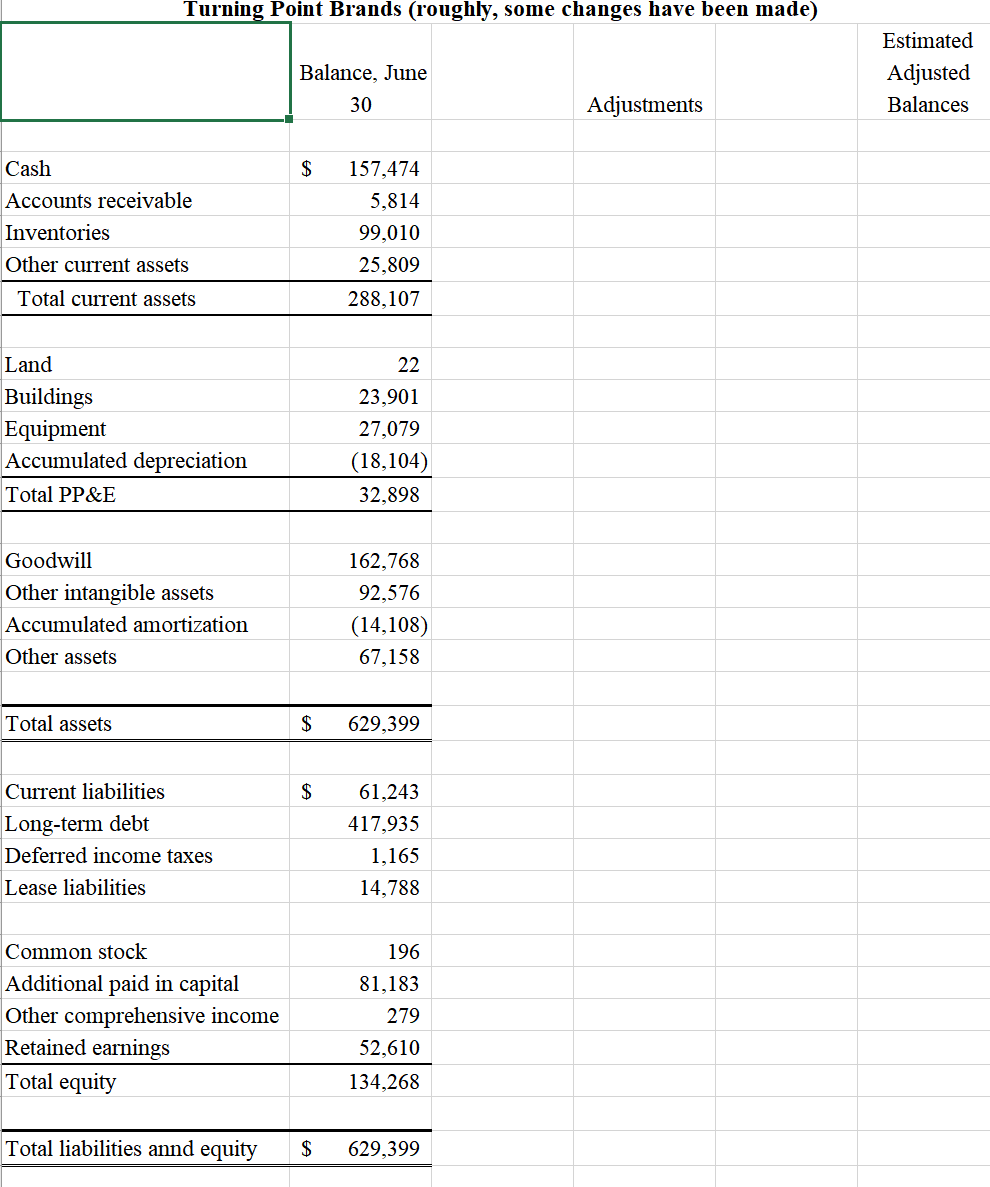

Stripes controller (chief accounting officer), Janet Levitan, has asked you to put together a statement of financial position showing what Turning Points statement of financial position will look like at acquisition. Janet tells you to use push down accounting for this assignment.

You ask her, Where do I get the fair value information? She says, Use your judgment. You smile and say Of course.

But of course, youre not exactly an expert on fair values.

Your assignment: Create a statement of financial position, adjusted for the acquisition. Use your judgment for fair values as necessary. Do not spend any time researching fair values, just do what you think is best. (And make sure it balances!) And of course it would be very unusual for two people to have the same answer, do this on your own.

Turning Point Brands (roughly, some changes have been made) Balance, June 30 Estimated Adjusted Balances Adjustments $ Cash Accounts receivable Inventories Other current assets 157,474 5,814 99,010 25,809 Total current assets 288,107 22 Land Buildings Equipment Accumulated depreciation Total PP&E 23,901 27,079 (18,104) 32,898 Goodwill Other intangible assets Accumulated amortization Other assets 162,768 92,576 (14,108) 67,158 Total assets $ 629,399 $ Current liabilities Long-term debt Deferred income taxes Lease liabilities 61,243 417,935 1,165 14,788 196 81,183 Common stock Additional paid in capital Other comprehensive income Retained earnings Total equity 279 52,610 134,268 Total liabilities annd equity $ 629,399Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started