Question

Assume that the estimated chargeable income for BANKU LTD for the 2016 year of assessment was GH100,000,000 but its actual chargeable income declared at

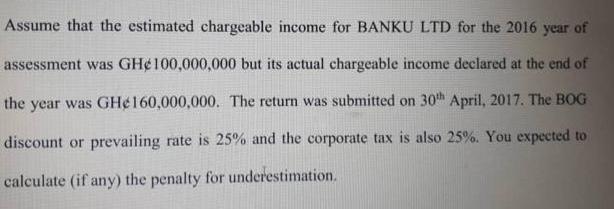

Assume that the estimated chargeable income for BANKU LTD for the 2016 year of assessment was GH100,000,000 but its actual chargeable income declared at the end of the year was GH160,000,000. The return was submitted on 30th April, 2017. The BOG discount or prevailing rate is 25% and the corporate tax is also 25%. You expected to calculate (if any) the penalty for underestimation.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The rate of penalty shall be fifty per cent of the tax payable on underreport...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Advanced Accounting

Authors: Floyd A. Beams, Joseph H. Anthony, Bruce Bettinghaus, Kenneth Smith

13th edition

134472144, 978-0134472140

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App