Question

Assume that the following events occurred at Lakewood, Incorporated last month. a. Incurred direct labor costs of $450,000. b. Completed work on 70 percent

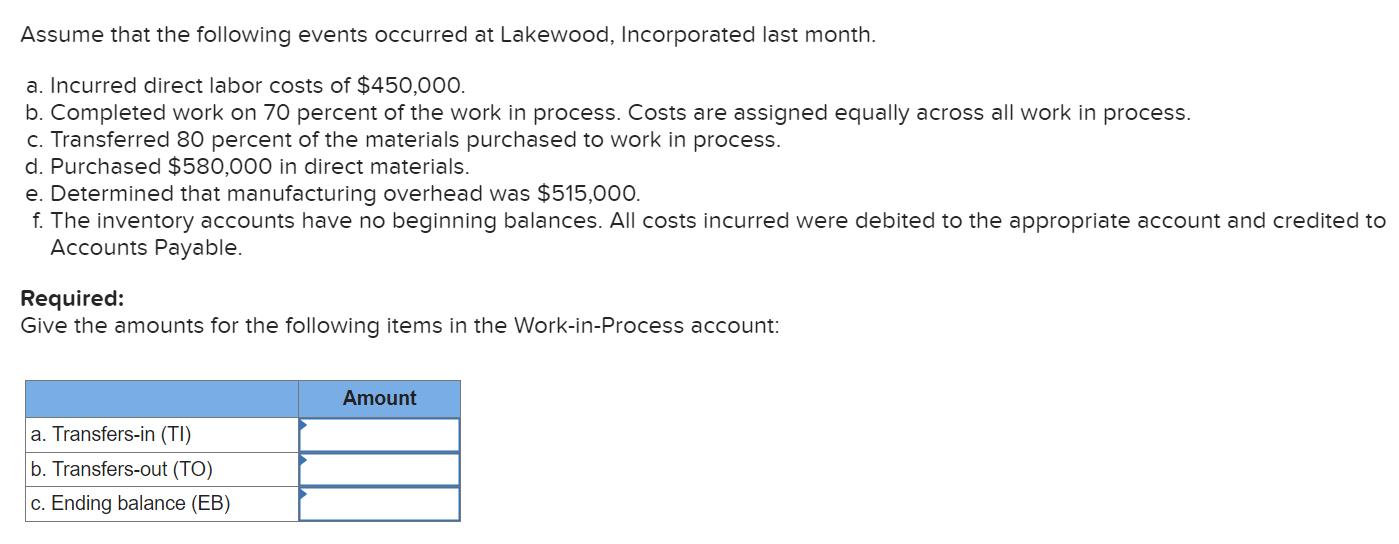

Assume that the following events occurred at Lakewood, Incorporated last month. a. Incurred direct labor costs of $450,000. b. Completed work on 70 percent of the work in process. Costs are assigned equally across all work in process. c. Transferred 80 percent of the materials purchased to work in process. d. Purchased $580,000 in direct materials. e. Determined that manufacturing overhead was $515,000. f. The inventory accounts have no beginning balances. All costs incurred were debited to the appropriate account and credited to Accounts Payable. Required: Give the amounts for the following items in the Work-in-Process account: a. Transfers-in (TI) b. Transfers-out (TO) c. Ending balance (EB) Amount

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Sure lets calculate the requested amounts based on the provided inform...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Accounting Principles

Authors: Jerry J. Weygandt, Paul D. Kimmel, Donald E. Kieso

9th Edition

978-0470317549, 9780470387085, 047031754X, 470387084, 978-0470533475

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App